Montréal real estate market – Consequences of rising rents for tenants and landlords

Montréal real estate market – Consequences of rising rents for tenants and landlords

Main information:

- Record rent increases: Average increase of 5.9% in 2025, reaching almost 10% in two years, one of the highest in 30 years.

- Direct impact on tenants: rising housing costs, migration to more affordable neighborhoods and the rise of home ownership.

- Opportunity for landlords: Adjustment of rents in line with inflation and increased charges, with possible increases of over 5.9% based on actual costs.

- Impact on the real estate market: Return of investors, increase in plex and condo sales, and rebalancing of the rental market.

- Adaptation strategies: Tenants and homeowners need to adapt through negotiation, exploration of new housing options or real estate investment.

In 2025, the rental market in Montreal and Quebec will see a historic rise in rents, the highest in 30 years, with an average increase of 5.9% for unheated units, according to the Rental Administration Tribunal (TAL). This rise, of almost 10% over two years, comes against a backdrop of high inflation and a property market under pressure, exacerbated by the housing crisis.

Faced with this situation, tenants have to adapt their budgets and, for some, consider changing accommodation or even buying a property. For their part, landlords will see this increase as an opportunity to adjust rents to their rising expenses, and de facto their yield, while ensuring they remain competitive on the market.

This dynamic will have a profound influence on the Montreal real estate market: more people are moving, investors are returning to rental properties, and more and more tenants are considering buying as a viable alternative to renting.

In this article, we analyze the reasons for this rise in rents, its impact on tenants and owners, and strategies for adapting to this new real estate reality.

Time needed: 7 minutes

- Why will rents rise so much in 2025?

- How much will rent rise for tenants in 2025?

- What rent increase can landlords apply in 2025?

- The impact of rising rents on the real estate market

- Rent increase strategy for tenants and landlords

Why will rents rise so much in 2025?

The year 2025 marks another significant rise in rents in Quebec, with an average increase of 5.9% for unheated dwellings and variable adjustments for other housing types. This increase, decided by the Housing Administrative Tribunal (TAL), is the largest in the last 30 years.

Several economic and structural factors explain this trend:

1. An economic context under stress

This decision can be explained by a number of economic factors, including :

- Persistent inflation: Despite a slowdown from the peaks of 2022-2023, inflation continues to affect the costs of energy, materials and maintenance services for rental properties.

- Rising management costs: building maintenance, administrative costs, property manager salaries, etc.

- Rising property insurance premiums: With inflation and rising weather-related claims, insurance is costing building owners more.

2. Strong growth in housing demand

At the same time, demand in the rental property market continues unabated:

- Imbalance between supply and demand: Montreal is experiencing a housing shortage, with a vacancy rate of around 2%, limiting options for renters.

- Influx of residents: Immigration and the attraction of the metropolis continue to fuel demand for rental housing, despite the slowdown sought by the government, particularly in central neighbourhoods.

- Fewer new builds: Growth in housing starts is struggling to keep pace with rental demand, putting further pressure on the market.

The Rental Board’s decision on rent increases

Each year, the TAL proposes a rate of rent increase based on the costs incurred by landlords. In 2024, the recommended average increase was 4%, rising to 5.9% in 2025, a cumulative increase of almost 10% in two years.

This increase is correlated to the overall rise of the real estate market in Montreal and Quebec. Don’t miss any market analysis with our weekly articles to decipher the latest trends and opportunities:

- Rent prices in Montreal: how does the city stack up against major metropolises?

- Montreal Real Estate Market – The best times to buy

- The impact of Donald Trump’s tariffs on the Canadian real estate market

- Variable or fixed rate in 2025: which is the better choice in the real estate market?

- Montréal real estate market – Consequences of rising rents for tenants and landlords

- Montréal Real Estate Market – Condo prices by neighbourhood and metro station

How much will rent rise for tenants in 2025?

With average rents rising by 5.9% in 2025, on top of the 4% increase in 2024, this means a cumulative rise of almost 10% in two years. This has a direct impact on tenants’ household budgets.

Example over one year (2024 → 2025)

A rent of $1,500 in 2024 rises to around $1,589 in 2025, an annual increase of $1,068.

A home costing $2,000 in 2024 will rise to $2,118, an annual increase of more than $1,400.

Example over two years (2023 → 2025, cumulative 10% increase)

A rent of $1,500 in 2023 rises to $1,560 in 2024, then to $1,653 in 2025, i.e. an additional $153 per month over two years (+$1,836 annually).

A home costing $2,000 in 2023 rises to $2,080 in 2024, then to $2,178 in 2025, for an annual increase of nearly $2,200 over two years.

For families and students, these increases may call into question their ability to stay in their current accommodation.

What is the maximum rent increase in 2025?

The 5.9% increase announced by the Housing Court is an average, but some tenants could face a higher increase due to :

- Indexation of charges: If the landlord pays for electricity or heating, he can adjust the rent in line with increases in energy costs.

- Major renovations: If major renovations have been carried out (roofing, windows, heating, etc.), the owner may apply an additional increase.

- Municipal increases: In some cities, where property taxes have risen more rapidly, landlords can pass on these costs to rents.

What rent increase can landlords apply in 2025?

Quebec landlords can apply an average rent increase of 5.9% for unheated dwellings, according to the recommendations of the Tribunal administratif du logement (TAL). However, certain adjustments are possible depending on the additional expenses borne by the owner.

Standard 5.9% increase: how is it calculated?

The TAL establishes a prime rate of increase each year, based on :

- Inflation and rising housing operating costs.

- Changes in municipal and school taxes.

- Variations in energy and maintenance costs.

Factors allowing rent increases in excess of 5.9%.

Owners can justify a higher increase if certain costs have risen significantly:

1. Owner-heated dwelling

If the landlord assumes the cost of heating or electricity, he can pass on the increase in energy rates to the tenant. This increase varies according to the type of energy used (electricity, gas, fuel oil) and the new tariffs applied.

2. Increase in municipal charges and taxes

If the municipal property tax or school tax increases, the homeowner can request a proportional increase. Montreal and several other municipalities have announced property tax increases for 2025, which will have a direct impact on rental costs.

3. Major work carried out on the building

If major renovations have been carried out (roofing, windows, insulation, heating), an additional increase may be requested. The owner must provide invoices and comply with the TAL calculation to establish a fair increase.

How do you calculate rent increases for landlords?

The Housing Administrative Tribunal provides an official calculation grid enabling homeowners to determine the increase they can apply, based on their actual costs.

Steps to calculate the increase :

1. Use the TAL calculation tool: Available on the TAL website, this tool allows you to precisely calculate the increase based on eligible expenses.

2. Take into account expenses and renovations: If additional expenses are incurred (heating, taxes, work), they can be included in the calculation.

3. Provide the necessary proof: Any increase in excess of 5.9% must be accompanied by proof (invoices, tax statements, etc.).

To access the TAL calculation tool: Official TAL calculator

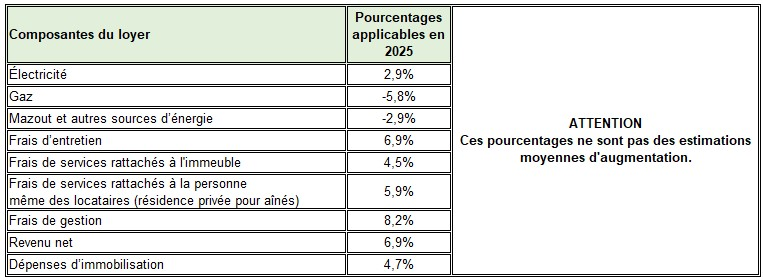

Schedule of increases applicable in 2025

Discover the official grid of achievable TAL increases:

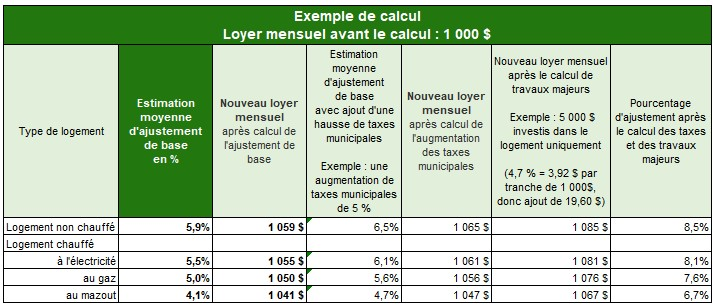

See an example of calculation provided by TAL:

Thus, the 5.9% increase is the norm for unheated homes, but adjustments are possible depending on the homeowner’s additional expenses. Before applying a higher increase, they must comply with the TAL rules and justify their increases with evidence (invoices, tax notices, etc.).

The impact of rising rents on the real estate market

The sharp rise in rents in 2025 will impact not only tenants and landlords, but also the entire Montreal real estate market. Several trends emerge from this situation, influencing tenant choices, the return of investors and the evolution of the resale market.

Tenants forced to move or buy

Faced with a cumulative increase of almost 10% in two years, many renters are having to re-evaluate their options: staying rented despite the increase, or considering buying a property.

Cost of rent vs. cost of a mortgage

With a cumulative increase of almost 10% in two years, many tenants will have to review their situation. Some will choose to stay renting by accepting this increase, but others will decide to move or become homeowners.

One of the key factors in this consideration is the comparison between the cost of rent and the cost of a mortgage. With the gradual fall in interest rates, buying a property is becoming a more viable option for some tenants, especially those with a sufficient down payment. Monthly mortgage payments are starting to approach the amount of their rent, making the purchase more attractive in the long term.

Faced with this reality, tenants are likely to move to more affordable neighborhoods. With rents in the city center skyrocketing, many households will be looking for more affordable options in the suburbs. Developing sectors offering good value for money are becoming particularly sought-after.

Finally, this situation is encouraging the emergence of a new wave of first-time buyers, particularly in the entry-level condo segment. For those who were still hesitating to buy, the rise in rents is encouraging them to invest in a property.

Investors back in the rental market

Rising rents, combined with falling interest rates, are making property investment attractive once again. After a wait-and-see period, investors are expected to return to the market, particularly in the small and medium-sized rental property sector.

Plexes are expected to become profitable again, as higher rents cover a larger portion of the mortgage. Until recently, rising financing costs had held back investors, but with falling interest rates, property profitability is gradually returning.

This dynamic should translate into an increase in transactions in the duplex, triplex, fourplex and fiveplex segments, which are particularly popular with owner-occupiers looking to maximize their investment.

At the same time, lower interest rates should boost purchases, making financing more accessible to investors. Those who had left the market because of unfavorable conditions are likely to return, attracted by a more stable market and rising rental income. With more attractive yields, many players will be looking to strategically reposition themselves by acquiring buildings offering good value potential.

In 2025, expect the most sought-after properties to be plexes and small rental buildings, which offer a good balance between acquisition cost and rental profitability, as well as downtown rental condos, which enjoy strong demand and require less management than an income property. Finally, buildings requiring major renovation will continue to attract buyers looking to generate long-term added value.

“With rents rising and rates falling, plexes are once again becoming strategic investments. By 2025, we expect renewed interest from buyers, particularly owner-occupiers looking to combine residence and profitability.”

Kyle Shapcott – leader in real estate

Greater supply on the resale market

With pressure on rents and changing interest rates, some rental property owners may opt to sell rather than continue operating. This trend will contribute to an increase in supply on the resale market, particularly in the income property segment.

Some landlords, anxious to cash in on their gains after several years of rising prices and worried about their tenants’ possible flight, may put their properties up for sale. This will result in an increase in inventory, offering more choice to buyers interested in real estate investment.

For their part, tenants looking to buy will fuel demand, which should focus on affordable housing, particularly entry-level condos and small plexes. All this could help sustain price growth despite the increase in available inventory.

Rent increase strategy for tenants and landlords

With rents having risen by almost 10% in two years, it’s essential to adopt the right strategies to optimize your situation, whether you’re a tenant or an owner. Here are a few recommendations for navigating this new real estate context in 2025.

Advice for tenants faced with rising rents

- Negotiating rent with your landlord: Before accepting a rent increase, it’s a good idea to talk things over with your landlord. Some may be open to a more moderate increase in exchange for a long-term commitment. A lease extension of 24 or 36 months can secure a more stable rate.

- Evaluate the cost of buying a property: With falling interest rates, some renters may find that the monthly cost of a mortgage becomes comparable to their rent. It’s a good idea to analyze your borrowing capacity and see whether buying real estate might be a better long-term option.

- Explore other neighborhoods or housing options: Faced with soaring rents in the city center, there are several alternatives:

- Look for emerging neighborhoods offering better value for money.

- Consider sharing or intergenerational housing to reduce costs.

- Take advantage of the new housing subsidies and grants on offer in 2025.

- Challenging an excessive increase with the TAL: If the requested increase seems disproportionate, the tenant can lodge a challenge with the TAL (Tribunal administratif du logement). The owner must then justify the increase in terms of the established criteria.

Advice for landlords on rising rents

With rents rising by almost 10% in two years, landlords are having to adapt their property management to maximize profitability while complying with the rules of the Housing Administrative Tribunal (HAT). A well-justified increase in rental income and a good relationship with tenants are essential to take advantage of this new market dynamic. Here are the strategies to adopt in 2025:

- Justifying and applying an increase in line with TAL rules: To avoid disputes, it is essential to :

- Use the official TAL calculation tool to determine a justified increase.

- Provide tenants with transparent information, explaining the costs that have risen (taxes, energy, maintenance, etc.).

- Optimize the profitability of your property: With rents rising and interest rates falling, property owners need to think long-term to maximize their investments:

- Renovate units to add value and justify a higher increase.

- Evaluate the possibility of converting a property into a furnished rental if local demand allows.

- Anticipate maintenance and repairs to avoid unexpected costs.

- Attracting and retaining quality tenants:A reliable tenant who pays rent on time is an asset. It may be more advantageous to :

- Limit excessive increases to maintain a good tenant over the long term.

- Offer benefits (minor work, maintenance included) to foster a lasting agreement.

- Take advantage of the return of investors to sell at the right time: Some owners may want to sell their rental property at a strategic moment:

- With higher rents, the value of rental properties can increase.

- The return of investors in 2025 could make it possible to sell at a more attractive price.

Conclusion

Rising rents in 2025 represent a major turning point for the Montreal real estate market. Between rising costs for tenants and a gradual return of investors, the rental landscape is in a state of flux. For some renters, this increase will accelerate the transition to home ownership, while others will have to rethink their housing strategy by exploring more affordable neighborhoods or opting for solutions such as sharing.

Landlords, for their part, benefit from an opportunity to adjust rents, but must remain competitive to avoid vacancies. The market for plexes and rental properties is regaining its attractiveness, buoyed by improved yields and more flexible financing conditions.

Against this backdrop, it is crucial for tenants and owners to adopt the right strategies to optimize their situation and take advantage of the new dynamics of the real estate market.

For personalized advice and successful real estate projects, contact our team of real estate brokers in Montreal.

Our blog is full of advice, analysis and real estate news:

- Decorating Tips for Making a New House Feel Like Home

- Rent prices in Montreal: how does the city stack up against major metropolises?

- Real estate Montréal : Real estate market statistics March 2025

- The Pros and Cons of Buying a New Construction Home

- Montreal Real Estate Market – The best times to buy

- The impact of Donald Trump’s tariffs on the Canadian real estate market

- Real estate Montréal : Real estate market statistics February 2025

- How to Spot a Home With Strong Resale Potential

- Variable or fixed rate in 2025: which is the better choice in the real estate market?

- Real estate market in Town of Mount Royal: The boom in single-family homes