Real estate Montréal : Real estate market statistics April 2025

Real estate Montréal : Real estate market statistics April 2025

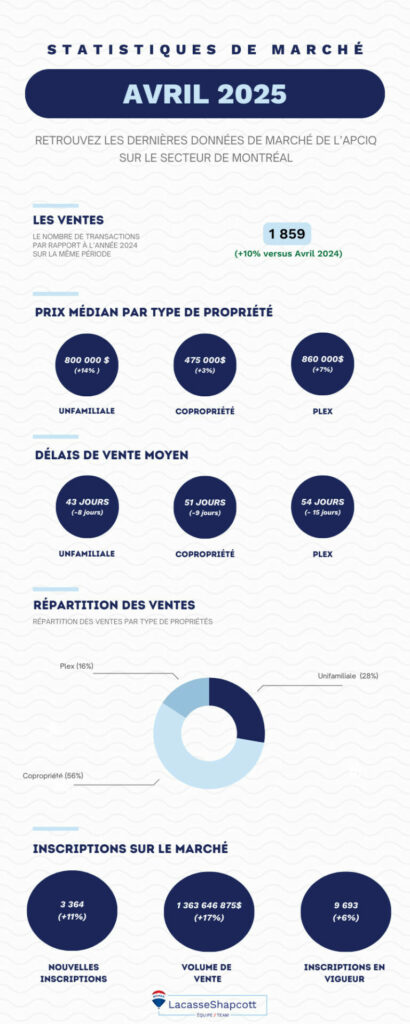

Main information:

- A 10% increase in the number of sales compared with April 2024, with a traded volume of $1.36 billion (+17%).

- Median prices rose in all segments, with a marked 14% increase for single-family homes.

- Supply continues to grow: 3,364 new listings this month, for a total of 9,693 properties in force.

- Sales lead times are shortening in all segments, confirming an active and absorbed market.

Montreal’s real estate market continues to grow in April 2025, in the wake of an upturn at the start of the year. Buoyed by sustained demand, sales continue to rise, accompanied by a general increase in prices.

This month’s data illustrates a double-digit increase in sales volume and number of transactions, fuelled by greater supply, seasonality and renewed buyer confidence in the market.. This trend confirms sellers’ confidence too, offering buyers more choice – without slowing down the absorption of well-located properties.

In this analysis, we decipher the key figures for the Montreal real estate market in April 2025, to provide you with a strategic reading of current opportunities and dynamics.

Time needed: 5 minutes

- Montreal real estate market – April 2025

- Montreal property prices – April 2025

- Sales lead times and distribution of properties sold in Montreal – April 2025

- Registrations and sales volume in Montreal – April 2025

Before you start reading, check out Kyle’s predictions for the second quarter of 2025:

Montreal real estate market – April 2025

The Montreal real estate market remains on course for April 2025 with sustained growth in activity. The number of sales reached 1,859 transactions, up 10% on April 2024.

This increase testifies to a buoyant market, underpinned by renewed interest from buyers despite a still challenging economic climate.

An ever-expanding product range to keep the market flowing

With 9,693 active listings (+6%) and 3,364 new listings this month (+11%), real estate supply continues to expand in Montreal. This renewed dynamism on the seller’s side directly fuels the rise in transactions observed in April.

For buyers, this means greater choice and a slight easing of competitive pressure. For sellers, on the other hand, this abundance calls for more strategic marketing: the right price positioning and meticulous presentation become essential to capture attention.

This gradual rebalancing is not slowing down activity, quite the contrary: it creates a context conducive to efficient sales, when the property is well aligned with market expectations.

Volume traded: double-digit growth

Total sales volume reached $1.36 billion, up 17% on April 2024. This growth can be attributed both to a higher number of sales and to the continued appreciation of property values, particularly in the condominium and single-family segments.

Sales lead times: properties find buyers faster

Sales lead times continue to fall, reflecting strong market absorption:

- Single-family: 43 days (-8 days)

- Co-ownership: 51 days (-9 days)

- Plex: 54 days (-15 days)

This general reduction in lead times confirms the sustained interest of buyers and the ability of well-positioned properties to sell quickly.

With indicators up sharply on all fronts – sales, listings, lead times and volume – April 2025 continues the trend of a resilient market. An environment that remains favorable to well-advised sellers, while creating new opportunities for buyers who know how to position themselves quickly.

Find out more about this month’s statistics in an infographic:

The data comes from the APCIQ (Association Professionnelle des Courtiers Immobiliers au Québec), see the full report here.

Montreal property prices – April 2025

Median prices continued to rise in April, confirming the strength of the Montreal real estate market. All segments are up, driven by active demand, a more favorable economic climate, and a gradual return to the market by investors.

| Property type | Median price – April 2025 | Annual variation |

|---|---|---|

| Single-family homes | 800 000$ | + 14% |

| Condominiums | 475 000$ | + 3% |

| Plex (2 to 5 properties) | 860 000$ | + 7% |

Single-family homes

With a median price of $800 000, up 14%, the single-family home segment posted the strongest annual increase in April.

This surge in demand reflects a strong craze for properties offering space, privacy and a stable living environment – particularly on the island’s outskirts, and highly sought-after by families. Despite the increase in listings, well-located homes continue to sell quickly, often with little room for negotiation.

If we take a step back and compare this price to the whole of 2024, current prices reflect an increase of 7%, a sign that the market is on a sustainable, long-term growth path.

Co-ownership

Median condominium price reaches $475,000, a moderate 3% increase.

This slowdown compared with previous months reflects a natural market adjustment after several quarters of sustained growth. Interest in condominiums remains high, however, due to their relative affordability, particularly for first-time buyers, and their time on the market is much shorter during the current peak season.

If we compare this price to the whole of 2024, current prices reflect an increase of 4%, testifying to this segment’s continuing strong market appeal.

Plexs

At $860,000, the median plex price is up 7% year-on-year.

This more moderate growth than in March reflects the repositioning of investors, who are still sensitive to interest rates and rental profitability. Well-located plexes with a good income/price ratio remain highly sought-after, especially in neighborhoods with strong rental demand.

Put in perspective with 2024, plexes have risen by 8%, a sign of sustained interest in this type of investment on the part of investors, who are gradually turning away from stock markets in times of instability.

Overall, the rise in prices in April 2025 confirms the strength of the Montreal market, with sustained momentum in single-family homes and resilience in plexes and condominiums. Despite a still uncertain economic climate, real estate remains a safe haven, especially for strategic buyers and well-informed investors.

“We’re seeing a marked return to confidence, among families and investors alike. Well-positioned properties – well-located, well-presented, well-priced – continue to attract strong interest and sell quickly. “

Kyle Shapcott, leader in real estate

Sales lead times and distribution of properties sold in Montreal – April 2025

Sales lead times continued to fall in April, a sign that the market is still active, well absorbed and in the high season. Against a backdrop of greater supply and slightly more flexible financing conditions, buyers remain reactive, particularly for well-located and correctly valued properties.

| Property type | Average selling time (days) | Annual variation |

|---|---|---|

| Single-family homes | 43 days | – 8 days |

| Condominiums | 51 days | – 9 days |

| Plex (2 to 5 properties) | 54 days | – 15 days |

Single-family homes: a marked acceleration

With an average turnaround time of 43 days, down 8 days on last year, single-family homes show one of the best sales rates on the market.

Family demand remains strong, especially for well-maintained properties in outlying neighborhoods. This speed illustrates a market where buyers are ready to act quickly as soon as a property ticks the right boxes: space, location and value for money.

Condominiums: an active, competitive market

Condominiums sell in 51 days on average, a decrease of 9 days over one year.

Despite the increase in the number of units available, shorter lead times show that the segment remains very active. Many buyers prefer this type of property, which is more affordable than single-family homes, especially in central neighborhoods. Well-positioned units sell quickly, especially when they are well presented and realistically priced.

Plexes: renewed investor interest

The plex segment shows an impressive reduction in lead times, down to 54 days (15 days less than in April 2024).

This net decline suggests a more aggressive return by investors, attracted by the rental income potential and long-term stability represented by this type of asset. Improved financing conditions may also have rekindled interest in more complex, but more profitable acquisitions in the medium term.

Sales breakdown – Montréal real estate market – April 2025

The breakdown of sales in April 2025 confirms the marked predominance of condominiums, which now account for 56% of transactions. They are followed by single-family homes (28%), then plexes (16%). This structure reflects buyers’ new priorities: accessibility, space efficiency and yield potential.

| Property type | Share of sales |

|---|---|

| Single-family homes | 56 % |

| Condominiums | 28 % |

| Plex (2 to 5 properties) | 16 % |

Condominiums: a pillar of the Montreal market

With more than one transaction in two, condominiums confirm their status as the driving force behind the Montreal residential market. Boosted by a varied offering, easier access to home ownership, and a strong appeal to urban living, they appeal as much to young buyers as to cautious investors. Their share is slightly down on March, but remains dominant.

Single-family homes: the lure of space is ever-present

Single-family homes accounted for 28% of sales, a significant increase over one month. This rise illustrates a renewed interest in space and stability, particularly among families willing to move away from the center to benefit from a better living environment. This segment, although more expensive, remains solid thanks to an active market and much shorter sales lead times.

Plexes: a niche that retains its value

With 16% of transactions, plexes gained one point compared with March, reflecting a measured but real awakening among investors. This segment remains strategic for those looking for an asset that generates rental income, even if buyers are more demanding in terms of actual profitability and the condition of the building.

Don’t miss any market analysis with our monthly real estate statistics:

- Real estate Montréal : Real estate market statistics April 2025

- Real estate Montréal : Real estate market statistics March 2025

- Real estate Montréal : Real estate market statistics February 2025

- Real estate Montréal : Real estate statistics January 2025

- Real estate Montréal : Real estate statistics December 2024

- Real estate Montreal : Real estate statistics November 2024

Registrations and sales volume in Montreal – April 2025

The Montreal real estate market continued its upward momentum in April, with supply continuing to grow and sales volumes rising sharply. These indicators confirm the vitality of a market that continues to generate numerous opportunities, provided you navigate it strategically.

| Property type | April 2025 | Annual variation |

|---|---|---|

| Active listings | 9 693 | + 6% |

| New listings | 3 364 | + 11% |

| Sales volume | 1 363 646 875 $ | + 17% |

A growing inventory, a market on the move

With 3,364 new listings (+11%) and a total of 9,693 properties on the market (+6%), April confirms a strengthening of supply. This increase means a greater diversity of properties, which helps transactions flow more smoothly and makes the market more balanced.

In more competitive sectors, buyers have more room for maneuver, which encourages them to be more selective. Conversely, well-positioned properties – i.e. professionally presented, correctly appraised, valued and ideally located – continue to be absorbed rapidly.

For sellers, this climate calls for increased rigor: marketing strategies must be beyond reproach to stand out in an environment where the offer is growing week by week.

Sales volumes up sharply

Total traded volume reached $1.36 billion, up 17% on April 2024. This performance was driven by two key factors: an increase in the number of transactions and higher median prices, particularly in the single-family home and condominium segments.

The gradual improvement in borrowing conditions continues to stimulate demand, as does the ongoing appeal of real estate as a safe haven. However, buyers are becoming increasingly informed and strategic, comparing options carefully before committing themselves.

In this context, the success of a sale now depends as much on the quality of the property as on the precision of the execution – a point where professional expertise makes all the difference.

“We’re in a market phase where supply is increasing without affecting the pace of sales. It’s an ideal window of opportunity, but one that requires precision, strategy and support to succeed.“

Kyle Shapcot, leader in real estate

Conclusion

The Montreal real estate market continues to grow steadily. The increase in the number of sales, the rise in prices, the speed of transactions and the growing abundance of supply testify to a balanced, growing but competitive market.

Buyers are more selective, but still present, and sellers must rely on a sharp strategy to maximize their chances of closing quickly. In a context where real estate continues to stand out as a safe haven, every decision – whether to buy, sell or invest – deserves to be backed by solid expertise.

Contact our team of Montreal real estate brokers today to benefit from a complete evaluation of your situation and maximize your opportunities in this fast-changing market.

Our blog is full of advice, analysis and real estate news:

- Real estate Montréal : Real estate market statistics April 2025

- Decorating Tips for Making a New House Feel Like Home

- Rent prices in Montreal: how does the city stack up against major metropolises?

- Real estate Montréal : Real estate market statistics March 2025

- The Pros and Cons of Buying a New Construction Home

- Montreal Real Estate Market – The best times to buy

- The impact of Donald Trump’s tariffs on the Canadian real estate market

- Real estate Montréal : Real estate market statistics February 2025

- How to Spot a Home With Strong Resale Potential

- Variable or fixed rate in 2025: which is the better choice in the real estate market?

- Real estate market in Town of Mount Royal: The boom in single-family homes

- Buying Near Schools: Does It Always Increase Property Value?