Montréal real estate market: How high will prices go?

Montréal real estate market: How high will prices go?

Main information:

- Real estate prices in Montreal have risen by 10.2% per year since 2019, a faster pace than in Toronto, Vancouver or the rest of Quebec.

- Today, it takes almost 50% of the median income to buy a home in Greater Montreal, a threshold deemed unsustainable by many analysts.

- Residential construction is hampered by rising costs, administrative delays and labor shortages, exacerbating the housing crisis.

- Despite high interest rates, creditworthy buyers prefer to secure their position now, for fear of future foreclosure.

- Buying or selling in 2025 requires preparation, a good understanding of the market and professional support to optimize your strategy.

Behind the appearance of a healthy market, Montreal continues to see prices rise at a steady pace. Since the pandemic, growth in real estate prices and rents has outstripped that observed in the rest of Canada. And while some are hoping for a slowdown, current data and SCHL projections tell a different story.

In this article, we analyze price trends, rental pressures, the limits of construction and the structural factors that explain why prices keep rising. We conclude with concrete advice for buyers, sellers and investors, keeping a realistic eye on what’s next.

Time needed: 5 minutes

- Montréal real estate market: How prices have changed in recent years

- Rents and homeownership costs in 2024 in Montreal

- Housing crisis: why can’t construction keep up?

- Why are prices continuing to rise in Montreal?

- Buying or selling in 2025: our team’s advice

Montréal real estate market: How prices have changed in recent years

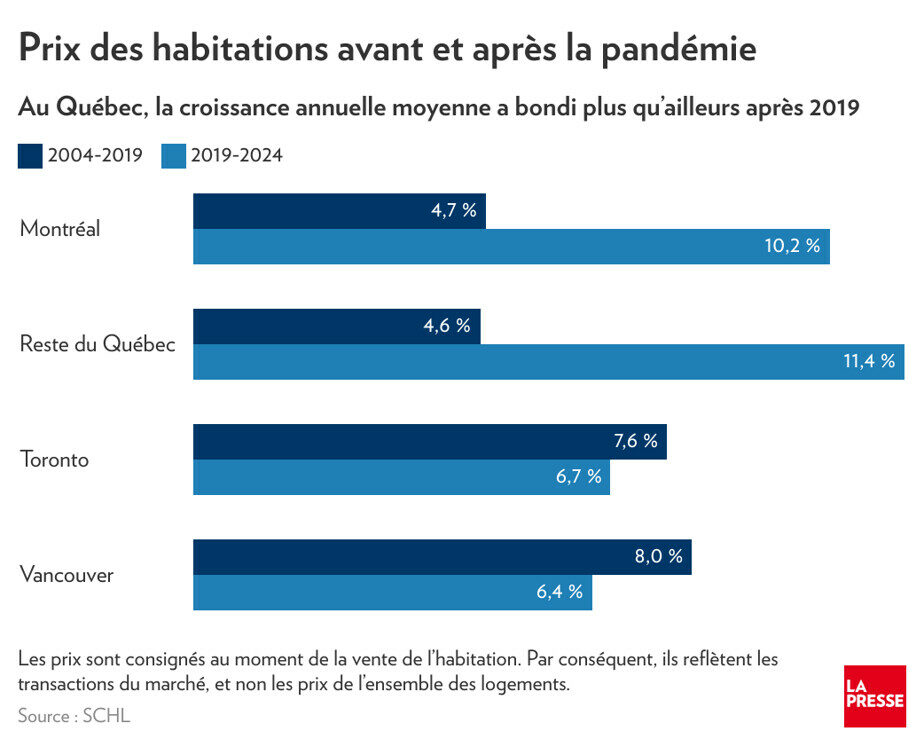

Between 2004 and 2019, home prices in Montreal rose by around 4.7% per year. Since the pandemic, this rate has more than doubled, reaching 10.2% per year between 2019 and 2024 (source: SCHL). In comparison, it’s faster than Toronto, Vancouver or even the rest of Quebec.

This leap is explained by a combined effect: historically low interest rates during the pandemic, a rush to property, low inventory, and a chronic construction backlog. The result: increased pressure on prices, with no turning back since.

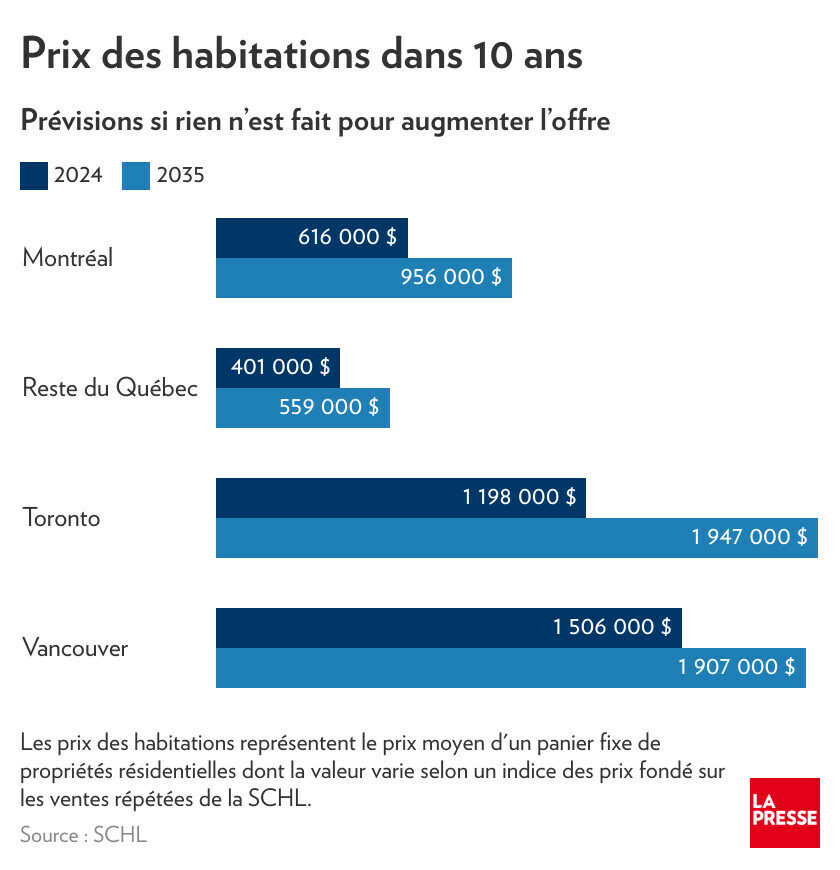

And there’s more to come. According to SCHL projections, the average price of a home in Montreal could rise from $616,000 in 2024 to $956,000 by 2035 if supply remains so limited.

As columnist Marie-Eve Fournier summed up in La Presse: “The number of factors pushing up prices is endless, and I can’t see the day when there will be significantly fewer of them.

La Presse

In Montreal, the current reality is one of a tight market, with prices rising faster than incomes. A structural imbalance that makes home ownership increasingly difficult.

The city has stood out in terms of price growth over the past 10 years, and projections continue to point in this direction, especially since the pandemic:

Don’t miss any market statistics with our monthly market report:

- Real estate Montréal : Real estate market statistics May 2025

- Real estate Montréal : Real estate market statistics April 2025

- Real estate Montréal : Real estate market statistics March 2025

- Real estate Montréal : Real estate market statistics February 2025

- Real estate Montréal : Real estate statistics January 2025

- Real estate Montréal : Real estate statistics December 2024

Rents and homeownership costs in 2024 in Montreal

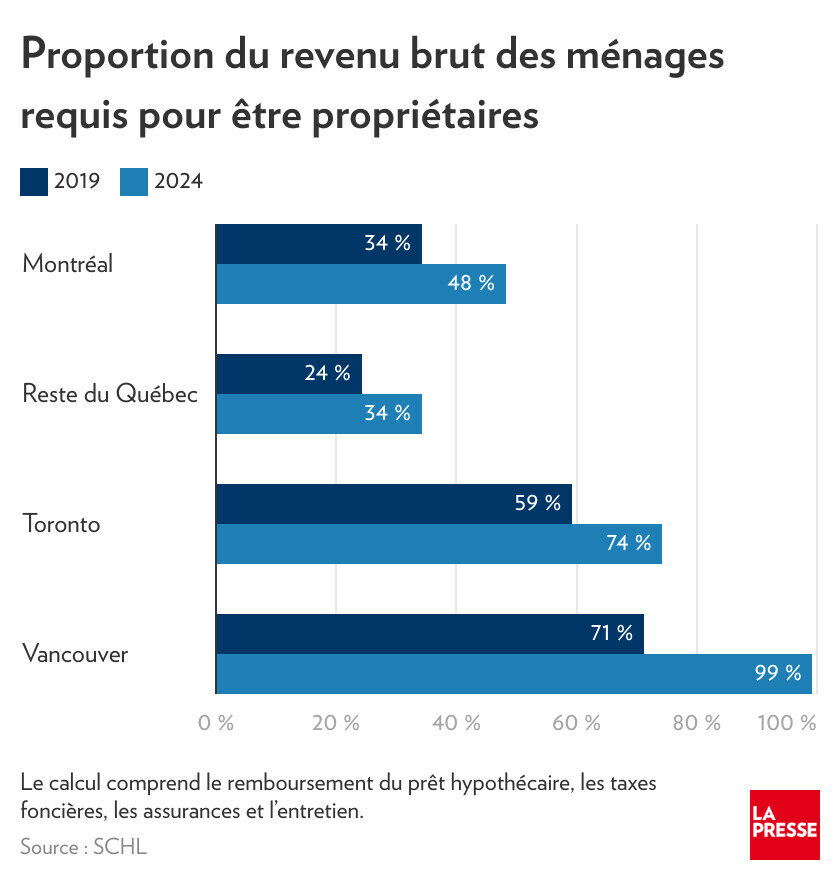

In Greater Montreal, households’ real estate purchasing power has shrunk in recent years (inflation, property prices…). Today, you have to spend almost 50% of your income to buy a house – a proportion considered excessive by many analysts. At the same time, rents have risen at an unprecedented rate over the past 5 years, creating a real bottleneck for young households and middle-income families.

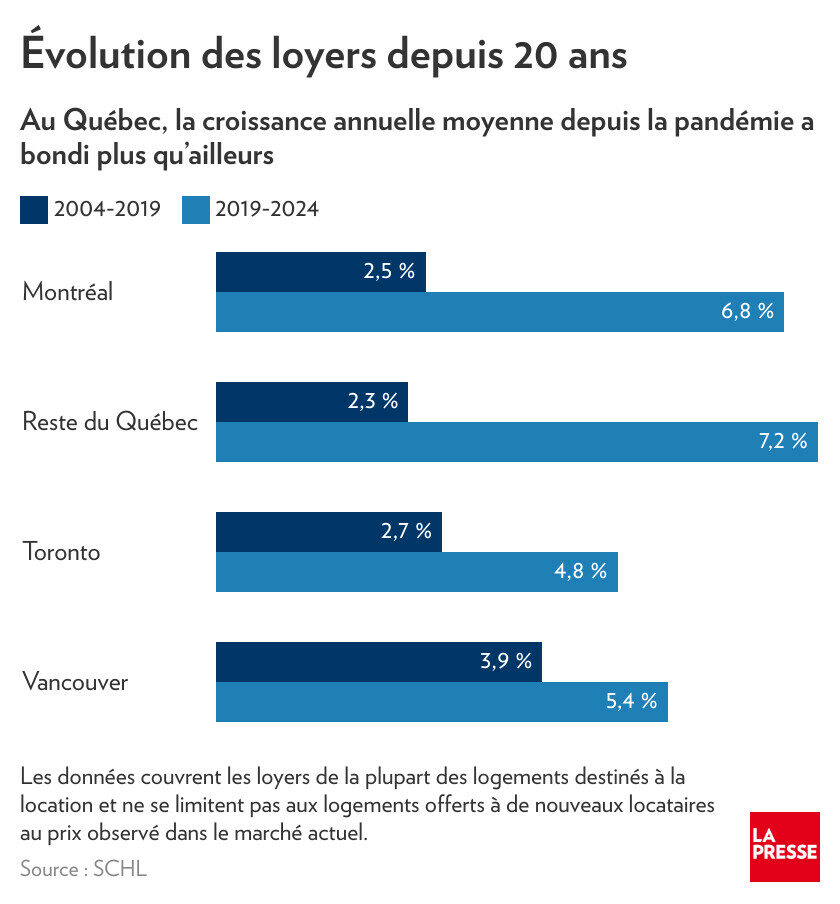

When we look at rent trends, the pressure is no less, and we can see that Montreal is one of the cities with the highest rent increases over the past 20 years:

This alarming finding reflects a reality: the financial tolerance threshold has been reached for a large proportion of tenants. And this pressure is not limited to rents.

“Today, in a building with 200 to 250 units, we record up to 12 cases of non-payment per month.”

Raymond Paré, president of Cogir

The Montreal real estate market is going through a major affordability crisis. On the one hand, purchase prices are skyrocketing: spending almost half one’s income on housing is becoming the norm, well beyond the thresholds usually considered sustainable. On the other hand, rents are skyrocketing, particularly on the island of Montreal, creating unbearable pressure on modest households and young families.

This double bind – rising rents + exploding mortgage costs – is pushing more and more households to the limit of their financial capacity, as evidenced by the worrying increase in rent arrears. At the same time, high interest rates are holding back purchases, reducing residential mobility and freezing an already tight market.

To find out more :

Housing crisis: why can’t construction keep up?

If property prices and rents are exploding, it’s also because supply is no longer keeping pace with demand. The housing crisis in Quebec – and particularly in Montreal – is fuelled by a chronic shortage of new construction, caused by an accumulation of structural impediments.

Real estate developers are sounding the alarm: delays in approvals, more demanding construction standards, rising material costs, high taxation, and a shortage of skilled labor are making many projects economically unviable. Results ? Projects are abandoned, housing is never built and investors are reluctant to develop new projects.

“In the last two years, I’ve abandoned four projects. Either I didn’t get an answer, or there was no infrastructure.”

Raymond Paré, president of Cogir

The SCHL (Canada Mortgage and Housing Corporation) itself makes a stark observation: without a major acceleration in construction, problems of access to housing will worsen. According to the organization, massive private investment, a reduction in administrative delays and modernization of the workforce would be needed to catch up.

But the necessary reforms take a long time to implement, are often unpopular locally (densification, high-rise housing, etc.) and are rarely high on political agendas.

A few facts and figures to help you understand the state of the construction market :

- Average construction cost per square foot: $130 5 years ago → $215 today

- Electricity cost per unit: $9,000 → $18,000

- Sector salary increase: +22% over 4 years (source: La Presse)

In short, the construction crisis has become a housing crisis. As long as the situation persists, price pressures – on both purchase and rental markets – are likely to worsen.

Why are prices continuing to rise in Montreal?

Real estate prices in Montreal continue to rise in tandem with strong sales growth. Several structural and cyclical factors explain this persistent rise.

Insufficient housing supply

The housing shortage is at the heart of the problem. As the SCHL reminds us in a recent report: “Housing affordability problems will clearly worsen without a significant increase in supply.” Yet many projects are held back by administrative delays, strict regulations or a lack of infrastructure. As a result, demand far outstrips supply, slowed by ever-rising construction costs.

“While the older market is doing well with inventory steadily rising, without inventory growth fueled by new construction, the market will struggle to stabilize its prices.”

Kyle Shapcott, real estate expert

Investors are cautious, but still present

Even if yields are falling, property remains a safe haven for investors. In times of inflation or economic turbulence, real estate offers a tangible form of stability, particularly in large conurbations like Montreal where structural demand remains strong.

The most solid projects – well-located, well-managed and adapted to today’s needs (family housing, energy-efficient buildings, rental units) – continue to attract capital and discerning buyers, all the more so when the stock market is volatile or bonds yield little after inflation. This constant flow of investors keeps prices up, even in a context where the general public is struggling to keep up.

Buyers want to secure their market position

In a context where inventory remains low and interest rates are fluctuating with no clear prospect of a short-term decline, solvent buyers prefer to act now rather than wait for a hypothetical lull.. The fear of a further rise in prices, or of tighter borrowing conditions, is pushing many households to take action despite the unfavorable conditions.

This dynamic fuels constant pressure on prices, as every property put on the market quickly finds takers, especially in well-served areas or on the outskirts of Montreal. Buying becomes a defensive strategy: better to lock in a rate and a price today, than risk exclusion tomorrow.

Buying or selling in 2025: Our team’s advice

The Montreal real estate market is complex, but not unpredictable. Here’s our practical advice if you’re considering a transaction this year.

Tips for buyers

1. Be financially prepared: Get your financing pre-approved, anticipate possible rate increases, and keep a margin for contingencies (inspection, notary, tax adjustment).

2. Buy for the long term: In a still tense market, the objective should remain stability. If you buy for 5 years or more, you reduce the risk of being affected by temporary fluctuations.

3. Don’t rely on window displays alone: Some properties fly under the radar or come back on the market at a reduced price. Work with a responsive broker who knows the area and can show you around as soon as an opportunity arises.

4. Make sure it’s a good investment: As analyzed in this article, the rise in prices on the island of Montreal seems well established and is unlikely to slow down over the next few years. By buying a property now, you can ensure attractive long-term added value.

5. Prioritize location and resale potential: In a market where every dollar counts, it’s crucial to choose a neighborhood with good growth prospects: access to transportation, development projects, quality of life. A well-located property is easier to sell, even in uncertain times.

Tips for sellers

1. Be strategic in your marketing: Good price positioning, professional photos and targeted distribution are essential. Gone are the days when everything sold out in a matter of days.

2. Be transparent and well-prepared: pre-sales inspections, documents in order, flexible visits: all these reassure buyers and speed up decisions.

3. Focus on the right channels: Today, visibility is also achieved through social networks, virtual tours and targeted campaigns. Make sure your broker has mastered these tools.

4. Don’t underestimate the importance of timing: Put on sale when inventory is low in your sector, to reduce competition. Strategic periods such as spring and autumn remain the most dynamic, but certain microperiods (just before the start of the school year, after a rate cut) can also create a windfall effect.

5. Anticipate negotiations: In a more balanced market, buyers negotiate more. Prepare yourself by knowing your property’s true value (recent comparables, renovations, unique features) so you can defend your price with confidence and flexibility.

In short, whether you’re buying or selling, the key to success in 2025 will be anticipation and strategy. The Montreal real estate market remains active, but more demanding than before. Surround yourself with competent professionals, stay informed, and act with lucidity: that’s how you’ll make the right choices, at the right time.

Conclusion

Despite hopes of a respite, everything points to Montreal real estate continuing its upward trajectory: between the persistent scarcity of supply, demographic pressure, construction costs and an uncertain economic context, prices are still finding reasons to climb. In this complex landscape, caution and preparation are more essential than ever.

Buyers, sellers or investors: understand the dynamics at work, follow the data and surround yourself with seasoned professionals. That’s how you’ll still be able to make the right moves – in a market that no longer forgives improvisation.

Trust our team of Montreal real estate brokers to ensure your purchase or sale is a success.

Our blog is full of advice, analysis and real estate news:

- Montréal real estate market: How high will prices go?

- Town of Mount Royal events this summer

- Real estate Montréal : Real estate market statistics May 2025

- Do Open Houses Still Work in the Age of Virtual Tours?

- Montréal real estate market: everything you need to know about Airbnb short-term rentals

- High-season real estate sales strategy

- How Family Dynamics Shape Real Estate and Moving Decisions

- Real estate Montréal : Real estate market statistics April 2025

- Decorating Tips for Making a New House Feel Like Home

- Rent prices in Montreal: how does the city stack up against major metropolises?

- Real estate Montréal : Real estate market statistics March 2025

- The Pros and Cons of Buying a New Construction Home