Real estate Montréal : Real estate market statistics February 2025

Real estate Montréal : Real estate market statistics February 2025

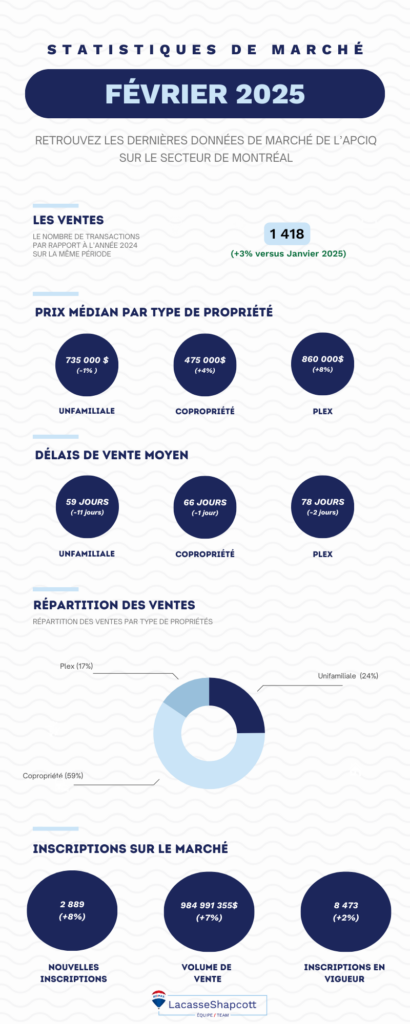

Main information:

- Increase in sales: The number of transactions rose by 3% compared with February 2024, confirming continued strong demand despite more abundant supply.

- Growing sales volume: At $984.9 million, transaction volume was up 7% year-on-year, reflecting an active and changing market.

- Median prices on the rise: Condominiums (+4%) and plexes (+8%) continue to appreciate, while single-family homes record a slight decline (-1%), reflecting an adjustment in the market.

- Shorter selling times: Single-family homes (59 days, -11 days) and condominiums (66 days, -1 day) are selling faster, while plexes (78 days, -2 days) remain attractive despite longer selling times.

- Increased inventory: The number of active listings reached 8,473 properties (+2%), offering buyers more choice and fostering a more balanced market.

- Stable sales mix: Condominiums still dominate the market (59% of transactions), followed by single-family homes (24%) and plexes (17%), confirming the diversity of opportunities for different buyer profiles

After a dynamic start to the year, the Montreal real estate market continued its momentum in February 2025, confirming the trend observed in recent months. Despite an economic context in transition and the gradual adaptation of households to new financial and geopolitical realities, the market remains solid and attractive, buoyed by lower key interest rates and strong buyer demand.

February’s statistics show a continued rise in sales compared to the same period last year, as well as an increase in transaction volume, demonstrating the continuing confidence of buyers and investors. Median prices continue to rise, with marked growth in the plex segment and stabilization in condominiums and single-family homes, signalling a more balanced market that is breathing easier after the fluctuations of recent years.

At the same time, sales lead times remain relatively short, testifying to the strong absorption of the market and the enthusiasm of buyers for well-positioned properties. Condominiums continue to be the most popular type of property, while single-family homes are still very attractive, particularly on the outskirts of the city center.

In this analysis, we decipher the key statistics for February 2025, to better understand market trends and anticipate opportunities for buyers and sellers over the coming months.

Time needed: 6 minutes

- Montreal Real Estate Market – February 2025

- Montreal property prices – February 2025

- Sales lead times and distribution of properties sold in Montreal – February 2025

- Registrations and sales volume in Montreal – February 2025

Montreal Real Estate Market – February 2025

In February 2025, the Montreal real estate market continues to grow, with a 3% increase in sales compared to February 2025. This increase, albeit moderate, testifies to continuing demand, despite a more uncertain economic climate stimulated by slightly lower interest rates.

A growing offer and an active market

The total number of listings on the market was 8,473, up 2% on the previous year. This slight increase in inventory offers buyers a greater diversity of choice, taking advantage of opportunities offered by sellers capitalizing on the price rises of recent years, making the market highly competitive.

Sales volume on the rise

Total sales volume reached $984.9 million, up 7% on the previous year. This growth reflects not only an increase in the number of transactions, but also a rise in the value of properties on the Montreal market.

Sales lead times and buyer behavior

Market activity is also reflected in the speed of transactions. This is reflected in sales times, which have fallen by between 1 and 11 days in each market segment, reflecting the dynamism of buyers who are determined to carry out their real estate projects, taking advantage of the favorable market conditions at the start of the year.

This reduction in lead times confirms that buyers are active and ready to position themselves quickly on properties that match their criteria. February 2025 thus marks a balanced and dynamic market, where demand remains strong despite a slight slowdown in sales compared to the start of the year. Prices continue to rise in certain segments, and shorter selling times reflect a market in favor of well-positioned sellers.

Find out more about this month’s statistics in an infographic:

Les données proviennent de l’APCIQ (Association Professionnelle des Courtiers Immobiliers au Québec), voir le rapport complet ici.

Montreal property prices – February 2025

In February 2025, median prices on the island of Montreal continue to rise, confirming the market’s attractiveness despite an economic context in transition. This trend demonstrates the strength of demand, particularly in the plex and condominium segments, which continue to appreciate in value.

The market’s dynamism is driven by several factors: the gradual fall in interest rates, the increase in new listings, the growing interest of urban investors and buyers, or the rise in rents and geopolitical uncertainties that are encouraging buyers to make a real estate investment, perceived as more secure.

| Statistics | Median price – February 2025 | Annual variation |

|---|---|---|

| Single-family homes | 735 000 $ | -1 % |

| Condominiums | 475 000 $ | +4 % |

| Plex (2 to 5 properties) | 860 000 $ | +8 % |

Single-family homes :

The median price of single-family homes reached $735,000, down 1% year-on-year. This moderate decline is due to a larger supply and an adjustment of the market after several months of rapid growth.

However, this stabilization does not reflect a weakening of the market, but rather a temporary rebalancing in a segment where demand remains strong, particularly on the outskirts of the city center.

Condominiums:

The median condominium price rises by 4%, reaching $475,000 in February 2025. This moderate increase illustrates the continuing appeal of this type of property, which remains more affordable than single-family homes and better suited to urban lifestyles.

The increase in condominium inventory on the market has eased pressure on prices, but demand remains high, especially for well-located, competitively-priced units.

Plexs :

With a median price of $860,000, up 8% year-on-year, plexes continue to show sustained growth, driven by investors’ growing interest in rental income.

This segment benefits directly from rising rents, falling interest rates and the return of buyers seeking to optimize their financing by combining occupancy and rental income. With interest rates falling, plexes remain an excellent choice for investors looking for attractive returns and a tangible asset in a constantly evolving market.

So, despite fluctuations from segment to segment, the Montreal real estate market continues to grow. Demand remains strong, supported by falling interest rates and renewed buyer confidence.

In a context where prices continue to evolve and opportunities abound, it is essential for buyers and sellers to be well informed and to surround themselves with experts to strategically navigate this competitive market.

“Stabilizing single-family home prices and rising plex prices show a market in full adaptation. Investors are returning, and urban buyers are maintaining strong demand for well-located condominiums.”

Kyle Shapcott, leader in real estate

Sales lead times and distribution of properties sold in Montreal – February 2025

Property sales lead times in Montreal – February 2025

In February 2025, sales lead times on the island of Montreal continue to reflect a competitive and selective market, where some segments are accelerating, while others are stabilizing.

Buyers, while still present, are adopting a more considered approach, particularly in segments where inventory is more abundant. On the other hand, some property categories are seeing their sales times shorten due to strong demand and limited supply.

| Property type | Average lead time (days) | Annual variation |

|---|---|---|

| Single-family homes | 59 days | -11 days |

| Condominiums | 66 days | -1 day |

| Plex (2-5 units) | 78 days | -2 days |

Single-family homes: a market under pressure

Single-family homes show an average selling time of 59 days, a significant drop of 11 days compared to February 2024.

This acceleration in the segment can be explained by several factors:

- Family demand for space and stability remains strong.

- Limited inventory keeps buyers competing.

- Slightly improved financing conditions, encouraging rapid completion of transactions.

Condominiums: a stable segment, but in favor of sellers

Condominiums sell in 66 days on average, virtually unchanged from the previous year, with a decrease of just one day.

Despite a more abundant supply, demand for this type of property remains strong, thanks in particular to :

- Relative affordability compared to single-family homes.

- Attractiveness of central districts.

- Lower interest rates, making it easier to buy than rent.

Although buyers are taking the time to compare available options, well-located and realistically priced units continue to sell quickly.

Plex: a segment that is slowing down slightly but remains attractive

With an average lead time of 78 days, down 2 days on February 2024, plexes retain their status as a popular investment, but transactions are taking a little longer to close.

Investors are analysing their acquisitions more closely, in particular because of :

- Changes in mortgage rates, which influence profitability

- The impact of rising rents on rental yields.

- Slightly more supply on the market, allowing buyers to be more selective.

Although they still take longer to sell than other segments, plexes continue to appeal thanks to their potential for value enhancement and passive income.

Sales breakdown real estate market February 2025

In February 2025, the breakdown of transactions illustrates the diversity of buyer profiles and confirms the continuing strong appeal of condominiums, followed by single-family homes and plexes.

| Property type | Share of sales (%) |

|---|---|

| Single-family homes | 59 % |

| Condominiums | 24 % |

| Plex (2-5 units) | 17 % |

Condominiums: the dominant segment

Condominiums accounted for 59% of sales in February 2025, confirming their status as the preferred option for urban buyers.

- More attractive affordability than single-family homes.

- A wide choice of available units, making it easy to decide.

- A lifestyle suited to young professionals and first-time buyers looking for proximity to amenities and transportation.

This segment continues to dominate the market thanks to sustained demand and a varied offering that enables buyers to find options to suit their budget and needs.

Single-family homes: still a strong market presence

With 24% of sales, single-family homes are still very popular, especially with families and buyers looking for stability.

- Improved financing conditions make home ownership easier

- The need for space and comfort drives some households to prioritize the purchase of a house over a condo.

- The segment’s competitiveness is leading to shorter lead times and higher demand.

Despite a more selective market, well-located and well-priced homes continue to sell quickly.

Plex (2 to 5 units): profitability continues to attract investors

Plexes accounted for 17% of transactions, down slightly on previous months but still a solid segment.

- The appeal of rental income continues to attract investors.

- Rising rents are improving returns on these properties.

- Buyers take longer to assess profitability, which explains the longer selling times.

This segment remains a safe bet for investors, despite more cautious buying decisions.

While condominiums remain the main choice of buyers, single-family homes are showing sustained momentum, driven by growing family demand. Plexes, meanwhile, continue to attract investors, although transactions are more considered.

“February’s figures show a still-active market, where segments are evolving in contrasting ways. While houses and plexes show strong demand, condos still dominate due to their accessibility and adaptability to urban buyers.”

Kyle Shapcott, leader in real estate

Registrations and sales volume in Montreal – February 2025

In February 2025, the Montreal real estate market continues to show sustained momentum in terms of new listings and rising sales volumes. This trend shows that the market is renewing itself, offering great opportunities for both buyers and sellers.

| Statistics | February 2025 | Annual variation |

|---|---|---|

| Active listings | 8 473 | +2 % |

| New listings | 2 937 | +8 % |

| Sales volume | 984,9 M$ | +7 % |

A growing inventory offering more choice

The market recorded 2,937 new listings in February, up 8% on February 2024.

Meanwhile, the total number of properties available on the market reached 8,473 active listings, an increase of 2%. This increase in inventory gives buyers more choice, allowing them to explore different options before making an informed decision. In certain segments where supply slightly exceeds demand, it also facilitates negotiation and avoids the excessive bidding seen in recent years.

However, this increase in listings means that sellers have to adapt to a market where buyers take the time to compare before positioning themselves. Realistic pricing and effective staging of properties become essential to capturing attention. Despite a more abundant supply, well-positioned and competitively priced properties continue to sell rapidly, particularly in areas where demand remains strong.

Significant sales volume

Total sales volume reached $984.9 million in February 2025, up 7% on the previous year. Although this increase is more moderate than in January, it testifies to a market that remains active and growing. This increase is fuelled by more attractive interest rates, which facilitate access to home ownership, an appreciation in median prices, particularly in the plex and condominium segments, and renewed activity on the part of investors, attracted by the stability of the rental market and the profitability of income properties.

However, this rise in transaction volume is accompanied by greater caution on the part of buyers. In a market where inventory is on the rise, they are taking more time to analyze available properties and assess their value for money before concluding a transaction. This behavior reflects a gradual rebalancing, where demand remains strong, but with a more selective and considered approach.

Don’t miss any market analysis with our monthly real estate statistics:

- Real estate Montréal : Real estate market statistics May 2025

- Real estate Montréal : Real estate market statistics April 2025

- Real estate Montréal : Real estate market statistics March 2025

- Real estate Montréal : Real estate market statistics February 2025

- Real estate Montréal : Real estate statistics January 2025

- Real estate Montréal : Real estate statistics December 2024

Conclusion

The Montreal real estate market continues to be dynamic in February 2025, with sales on the rise, transaction volumes on the rise and prices continuing to evolve. Despite a moderate increase in inventory, demand remains buoyant, driven by more favorable financing conditions and renewed confidence among buyers and investors.

While the plex segment is experiencing strong growth, condominiums continue to dominate the market, while single-family homes remain highly sought-after, especially on the outskirts of downtown.

With supply more abundant and sales volumes on the rise, the market continues to offer strategic opportunities, whether for first-time buyers, investors looking to optimize their returns, or sellers wishing to maximize the value of their property in a market in transition.

Whether you’re buying, selling or investing, it’s essential to anticipate trends, stay well-informed and surround yourself with experts to take advantage of current market conditions. Every decision can have a significant impact, and a personalized analysis can help you optimize your strategy.

Contact our team of Montreal real estate brokers today for an in-depth analysis and advice tailored to your situation.

Our blog is full of advice, analysis and real estate news:

- Montréal real estate market: Trends to watch for summer 2025

- Montréal real estate market: How high will prices go?

- Town of Mount Royal events this summer

- Real estate Montréal : Real estate market statistics May 2025

- Do Open Houses Still Work in the Age of Virtual Tours?

- Montréal real estate market: everything you need to know about Airbnb short-term rentals

- High-season real estate sales strategy

- How Family Dynamics Shape Real Estate and Moving Decisions

- Real estate Montréal : Real estate market statistics April 2025