Real estate Montréal : Real estate market statistics March 2025

Real estate Montréal : Real estate market statistics March 2025

Main information:

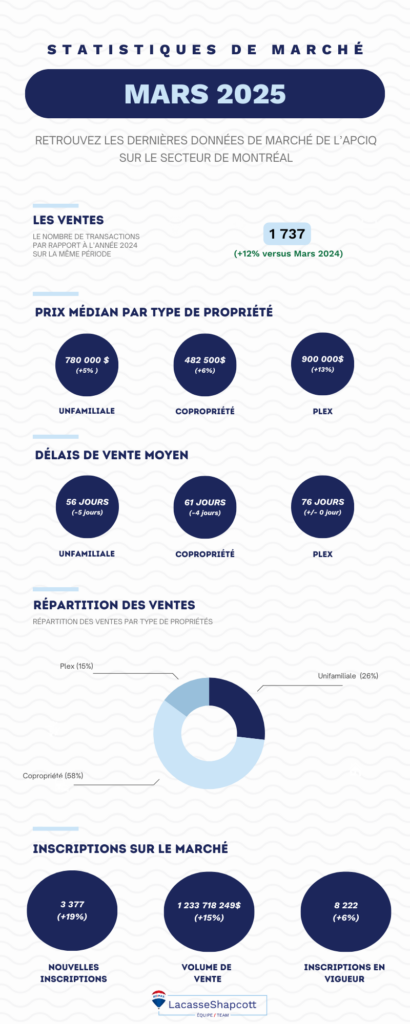

- Sharp rise in sales: The number of transactions rose by 12% compared with March 2024, illustrating the continuing vitality of the Montreal real estate market.

- Strong growth in sales volume: Transaction volume reached $1.23 billion, up 15% year-on-year, underpinned by sustained activity from buyers and investors.

- Rising median prices: Prices continue to rise, particularly for plexes (+13%), condominiums (+6%) and single-family homes (+5%), confirming solid demand in all segments.

- Shorter selling times: Single-family homes (56 days, -5 days) and condominiums (61 days, -4 days) are selling faster, while plexes (76 days, stable) are still attracting investors.

- Significant increase in inventory: The number of active listings reaches 8,222 properties (+6%), and new listings jump by 19%, offering buyers more choice.

- Distribution of sales unchanged: Condominiums still dominate the market (58% of transactions), followed by single-family homes (26%) and plexes (15%), reflecting a continued diversification of buyer profiles.

After an upturn in the first quarter, the Montreal real estate market confirmed its strength in March 2025. Buoyed by sustained transactional activity and a general rise in prices, the market is demonstrating impressive resilience despite an economic context still marked by global uncertainty.

The March statistics show significant growth in the number of sales and volume transacted compared to last year, supported by a strong influx of new listings. The marked rise in median prices, particularly in the plex segment, reflects renewed investor interest and confidence in the rental potential of the Montreal market, to the detriment of the stock market, which is losing confidence.

At the same time, sales times remain stable or slightly down, illustrating strong absorption of well-positioned properties. Condominiums confirmed their status as star products, accounting for nearly six out of every ten transactions, while single-family homes and plexes continued to attract a diversified clientele looking for space or yield.

In this analysis, we explore in detail Montreal real estate statistics for March 2025, to decipher major market trends and offer strategic advice to buyers and sellers for the coming spring.

Time needed: 6 minutes

- Montreal real estate market – March 2025

- Selling prices of properties in Montreal – March 2025

- Sales lead times and distribution of properties sold in Montreal – March 2025

- Registrations and sales volume in Montreal – March 2025

Before you start reading, find Kyle’s predictions for the second quarter of 2025 :

Montreal real estate market – March 2025

In March 2025, the Montreal real estate market confirmed its positive momentum, with a 12% increase in sales compared to March 2024, demonstrating the vitality of the market, driven by sustained demand and buyers’ gradual adjustment to new financing conditions.

Significant growth in supply and a market on the move

The total number of active listings reached 8,222, an increase of 6% over the previous year. This growth in inventory, combined with a 19% jump in new listings, helps to diversify the supply available on the Montreal market.

It offers buyers a wider range of choices, while fostering a slightly more competitive environment for sellers.

Strong growth in sales volume

Total sales volume amounted to $1.23 billion, up a significant 15% on March 2024. This increase reflects not only a higher number of transactions, but also the continued appreciation of properties, particularly in the plex segment.

Sales lead times and buyer behavior

Average selling times continue to reflect an active market:

- Single-family: 56 days (-5 days).

- Co-ownership: 61 days (-4 days).

- Plex: 76 days (stable).

This compression of lead times for single-family homes and condominiums confirms the strong absorption of well-positioned products. Buyers are always determined, responsive and inclined to close quickly when a property matches their expectations.

March 2025 thus continues the trend of a well-balanced market, where the range is expanding without slowing down sales momentum. The marked rise in prices in certain segments, notably plexes, and shorter selling times are evidence of an environment that remains favourable to well-prepared sellers, while offering good opportunities to strategic buyers.

Find out more about this month’s statistics in an infographic:

Les données proviennent de l’APCIQ (Association Professionnelle des Courtiers Immobiliers au Québec), voir le rapport complet ici.

Montreal property prices – March 2025

As of March 2025, median prices on the island of Montreal continue to climb, supported by resilient demand and a more favorable financial environment for borrowers. This trend confirms the robustness of the Montreal real estate market, particularly in the plex segment, which is posting double-digit growth.

Several factors explain this dynamic: the gradual fall in interest rates, which is giving households back their purchasing power, the continuing appeal of rental investment against a backdrop of high rents and depressed stock markets, and buyers’ desire to secure a tangible asset in a still uncertain economic climate.

| Statistics | Median price – March 2025 | Annual variation |

|---|---|---|

| Single-family homes | 780 000$ | +5% |

| Condominiums | 482 500$ | +6% |

| Plex (2 to 5 properties) | 900 000$ | +13% |

Single-family homes

The median price of single-family homes reached $780,000, up 5% year-on-year, a moderate increase that confirms the strength of this segment, supported by ongoing demand for properties offering space and comfort, particularly in outlying neighborhoods.

This controlled growth suggests a healthy market, where buyers are taking advantage of a slightly more abundant supply while remaining sensitive to the quality of the properties on offer. Well-located, well-maintained homes continue to sell quickly, often after only a few days on the market.

Condominiums

The median price of condominiums stands at $482,500, up 6% on March 2024. This steady growth illustrates the enduring appeal for buyers of this type of property, which combines accessibility, urban living and investment security.

The marked increase in the number of new listings in March has eased the pressure on prices slightly, but demand remains strong, particularly for well-located, value-for-money units. Condominiums close to transport hubs and dynamic neighborhoods continue to attract a great deal of interest.

Plexs :

With a median price of $900,000, up 13% year-over-year, plexes are one of the best-performing segments on the Montreal market.. This dynamism is directly linked to the growing appeal of rental investment, stimulated by the steady rise in rents and the fall in interest rates.

The possibility of combining occupancy and rental income makes plexes a strategic choice for many buyers, particularly in a context where real estate profitability remains more attractive than many other investments. This trend confirms the massive return of investors to the market.

While dynamics vary from segment to segment, the Montreal real estate market continues to grow, driven by sustained demand, favorable financing conditions and a palpable renewal of confidence among buyers and investors.

In such a competitive environment, it’s more important than ever to surround yourself with seasoned professionals to successfully navigate the opportunities and challenges of the market.

“The rapid rise in plex prices, combined with the stability of single-family homes and strong demand for well-located condominiums, testifies to a market in full evolution. Investors are back, and urban buyers are confirming their appetite for Montreal.”

Kyle Shapcott, leader in real estate

Sales lead times and distribution of properties sold in Montreal – March 2025

Property sales lead times in Montreal – March 2025

In March 2025, sales lead times on the island of Montreal confirm a still dynamic market, with variations according to segment. While some property categories are benefiting from an acceleration in sales, others are experiencing a stabilization of lead times, reflecting a selective and well-informed market.

Buyers remain active and ready to act quickly on well-positioned properties, particularly against a backdrop of slightly improved borrowing conditions and a more diversified quality offering.

| Property type | Average lead time (days) | Annual variation |

|---|---|---|

| Single-family homes | 56 days | – 5 days |

| Condominiums | 61 days | – 4 days |

| Plex (2-5 units) | 76 days | Stable |

Single-family homes: an accelerating segment

Single-family homes now sell in 56 days on average, 5 days less than in March 2024. This reduction in lead times confirms the segment’s strong competitiveness, driven by :

- Sustained family demand for larger living spaces.

- Supply still relatively limited in sought-after sectors.

- Gradual improvement in financing conditions, encouraging rapid completion.

Well-positioned homes, particularly in peripheral neighborhoods offering good value for money, continue to attract strong interest.

Condominiums: a fluid, dynamic market

With an average selling time of 61 days, condominiums have seen a significant acceleration compared to last year (-4 days).

Several factors underpin this dynamism:

- Increased affordability of condominiums compared to single-family homes.

- Attractiveness of central districts and recent high-quality projects.

- Lower interest rates, making home ownership easier for first-time buyers.

Despite an increasing supply, well-located and competitively priced units continue to find takers quickly.

Plex: a solid but more thoughtful investment segment

Plexes record an average lead time of 76 days, stable compared with March 2024. Although the purchasing process takes slightly longer, this segment remains very attractive.

This relative stability can be explained by :

- A more in-depth analysis of investment opportunities, particularly in terms of rental profitability.

- A broader offer enabling buyers to be selective.

- Growing interest in passive income amid rising rents.

Despite slightly longer lead times, plexes continue to attract seasoned investors and owner-occupiers in search of yield.

Sales breakdown – Montréal real estate market – March 2025

In March 2025, the breakdown of sales confirms a strong predominance of condominiums, followed by single-family homes and plexes. This structure clearly illustrates the changing needs of Montreal buyers, between accessibility, the search for space and rental investment.

| Property type | Share of sales (%) |

|---|---|

| Single-family homes | 58% |

| Condominiums | 26% |

| Plex (2-5 units) | 15% |

Condominiums: the number one choice of urban buyers

Condominiums account for 58% of sales in March 2025, confirming their central role in the Montreal real estate market..

The diversity of the condominium offering means that buyers can find products to suit their needs and budgets, underpinning their dominance of the market.

Single-family homes: still a popular segment

With 26% of transactions, single-family homes continue to attract customers looking for stability and space.

Although representing a smaller share than condominiums, the single-family home segment remains essential, especially for families looking for a sustainable living environment.

Plex: a safe investment value despite a more selective approach

Plexes will account for 15% of sales in March 2025. Although this figure is slightly down on previous months, the segment remains attractive to investors.

The slight drop in transaction volume is mainly due to a more methodical approach on the part of buyers, who take the time to accurately assess potential returns before committing themselves.

“The March figures confirm an active market, where condominiums remain the first choice thanks to their affordability, while houses and plexes continue to attract varied and strategic buyer profiles.”

Kyle Shapcot, leader en immobilier

Registrations and sales volume in Montreal – March 2025

As of March 2025, the Montreal real estate market continues to show robust momentum, with a marked increase in new listings and a sharp rise in sales volume. This vitality testifies to a market that is renewing itself and continues to offer opportunities for buyers and sellers alike.

| Statistics | March 2025 | Annual variation |

|---|---|---|

| Active listings | 8 222 | +6 % |

| New listings | 3 377 | +19 % |

| Sales volume | 1 233 718 249$ | +15 % |

A growing inventory, a booming market

March saw 3,377 new listings, an impressive 19% increase on March 2024.

At the same time, the total number of active listings rose by 6% to 8,222. This significant increase in supply helps to diversify the options available to buyers, enabling them to better compare properties before making a decision.

In segments where supply begins to outstrip demand, conditions become more balanced, offering buyers some negotiating power. However, well-positioned properties – i.e. correctly appraised, well presented and ideally located – continue to sell quickly, illustrating the importance of an appropriate marketing strategy.

For salespeople, this context calls for a rigorous approach: realistic pricing, impeccable presentation and a well-crafted marketing plan are more than ever the differentiating factors.

Strong growth in sales volume

Total sales volume reached $1.23 billion in March 2025, an impressive 15% year-on-year growth.

This increase was driven by several key factors:

- An increase in the number of transactions.

- Rising median prices, particularly in the plex segment.

- Investors are back in force, attracted by a stable and profitable rental market.

- The positive impact of falling interest rates on borrowing capacity.

Nevertheless, this effervescence is accompanied by a change in buyer behavior: more selective, better informed and strategic, they don’t hesitate to take the time to evaluate all the options before taking the plunge.

This gradual rebalancing reinforces the need for sellers to be competitive and adapt to new market expectations.

Don’t miss any market analysis with our monthly real estate statistics:

- Real estate Montréal : Real estate market statistics May 2025

- Real estate Montréal : Real estate market statistics April 2025

- Real estate Montréal : Real estate market statistics March 2025

- Real estate Montréal : Real estate market statistics February 2025

- Real estate Montréal : Real estate statistics January 2025

- Real estate Montréal : Real estate statistics December 2024

Conclusion

The Montreal real estate market continues to show strong momentum in March 2025, with sales up sharply, transaction volume up sharply and median prices continuing to climb, particularly in the plex segment.

Despite a significant increase in inventory, demand remains robust, underpinned by more favorable financing conditions, an attractive rental market and renewed confidence among buyers and investors in this investment segment.

In a context where supply is expanding and buyers are becoming more selective, the Montreal real estate market continues to offer genuine strategic opportunities: whether to secure a first purchase, invest in a rental property or optimize the sale of one’s property.

Whether you’re buying, selling or investing, it’s more important than ever to understand current trends, get the right advice and build the right strategy. Every real estate decision affects your financial future; personalized analysis and expert guidance can make all the difference.

Contact our team of Montreal real estate brokers today to benefit from a complete evaluation of your situation and maximize your opportunities in this fast-changing market.

Our blog is full of advice, analysis and real estate news:

- Condo vs. Townhouse: Which Lifestyle Fits Your Future?

- Montréal real estate market: Trends to watch for summer 2025

- Montréal real estate market: How high will prices go?

- Town of Mount Royal events this summer

- Real estate Montréal : Real estate market statistics May 2025

- Do Open Houses Still Work in the Age of Virtual Tours?

- Montréal real estate market: everything you need to know about Airbnb short-term rentals

- High-season real estate sales strategy

- How Family Dynamics Shape Real Estate and Moving Decisions

- Real estate Montréal : Real estate market statistics April 2025

- Decorating Tips for Making a New House Feel Like Home

- Rent prices in Montreal: how does the city stack up against major metropolises?