The importance of location in your real estate project

The importance of location in your real estate project

Main information:

- The city’s dynamism is crucial: a city with a growing economy and population guarantees strong demand and long-term value enhancement.

- The neighborhood needs to be strategic: Give preference to developing or well-established neighborhoods, close to infrastructure and amenities.

- The immediate environment counts: Safety, brightness and pleasant views are decisive factors in a property’s appeal.

- Proximity to transport and services is a major asset: Properties with good transport links and close to schools, shops and green spaces attract more buyers and tenants.

- A good location is a lever for value enhancement: it guarantees easy resale, stable rental demand and long-term added value.

When it comes to real estate, there’s one fundamental principle you should always bear in mind: “location, location, location!” This mantra emphasizes that location is the number one factor in determining the success of your real estate project, whether it’s a primary residence or a rental investment.

In this article we explore the different levels of location and the advice you need to make the right choice for your future real estate project.

Time needed: 5 minutes

- The city: Why the choice of city is strategic

- Neighborhood: A key factor in the success of your investment

- Neighborhood: A key factor in the success of your investment

Location is more than just an address on a map. It encompasses the city, the neighborhood, and even the specific features of the property. Each choice has a direct impact on the value of the property, its attractiveness, and its ability to generate income or resell easily.

Whether you’re a first-time buyer, an investor or an experienced buyer, understanding the importance of location is essential to maximizing your chances of success.

The city: Why the choice of city is strategic

Choosing the right city to invest in is the starting point of any real estate project. An economically dynamic city, with strong demographic growth and modern infrastructure, offers fertile ground for adding value to a property. Conversely, a stagnant or declining city can limit long-term appreciation prospects.

Economic dynamism: driving real estate demand

A city with an attractive economic environment attracts workers, families and students, boosting rental demand.

Major economic hubs, such as technology, university and industrial centers, act as magnets for new residents. This is reflected in steadily rising property prices and/or low rental vacancies.

“Investing in a city undergoing rapid economic growth means ensuring that your property evolves with the market and gains in value over time.”

Valérie Lacasse, leader in real estate

Population growth: a key valuation indicator

A growing population is a sign of sustained demand. Cities that attract new residents thanks to their quality of life, employment opportunities and modern infrastructure offer significant value-adding potential. At the same time, it’s essential to keep an eye on long-term trends, such as transportation projects, urban renewal zones or public investments, which contribute to a city’s attractiveness.

The indicators to be studied for this :

- Demographic trends

- Schools and universities

- The city’s age pyramid

Quality of life and infrastructure: a differentiating criterion

Cities that invest in green spaces, quality schools and efficient public transport are highly sought-after.

A good quality of life attracts not only local buyers but also foreign investors, increasing market competition and property values. Montreal, for example, is renowned for its balance between urban life and natural spaces, making it a destination of choice for investors and residents alike.

Pro tips: Make sure the city you’re targeting has any upcoming or ongoing development projects that could have an impact on the value of your property.

Local taxation: an often underestimated lever

Local taxation can make all the difference to the profitability of a real estate project or your future monthly payments on your principal residence.

Some cities offer tax benefits to investors, such as tax reductions or purchase incentive programs. These elements can significantly increase your net returns and make one city more attractive than others.

On the other hand, some cities apply their own taxes, which should be studied before choosing a property.

Neighborhood: A key factor in the success of your investment

While the city is a fundamental criterion, the neighborhood in which your property is located can make all the difference between a successful investment and a loss of value. The neighborhood directly influences the attractiveness, rental demand and ease of resale of your property. To make the right choice, it’s essential to assess the neighborhood’s specific characteristics, development potential and long-term prospects.

Neighborhood development: building on future potential

Neighborhoods undergoing urban renewal or development often represent attractive investment opportunities. These areas generally benefit from a temporary discount due to a lack of infrastructure or a less favorable perception. However, the arrival of new transit lines, shopping centers or universities can transform these neighborhoods into attractive hubs in just a few years.

In Montreal, for example, projects such as the REM (Réseau Express Métropolitain) or the revitalization of certain industrial zones have boosted the value of many previously less desirable neighborhoods. Investing in these areas before they reach their full potential can generate significant capital gains over the medium and long term.

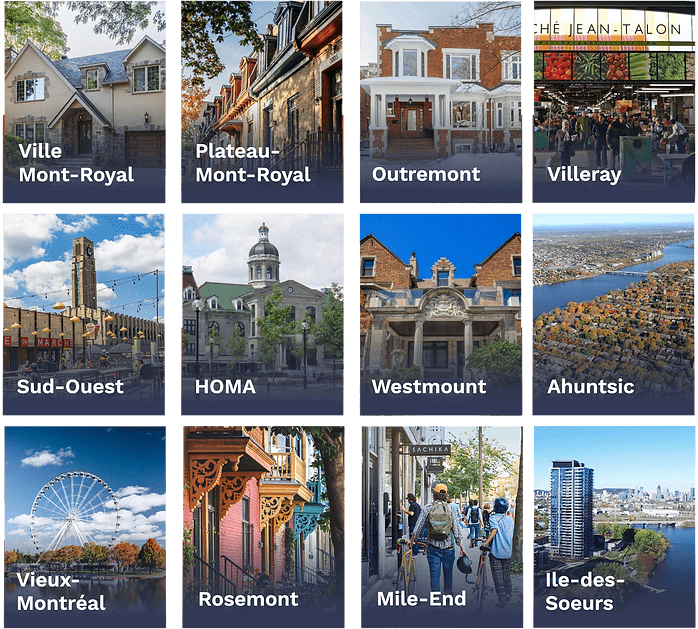

If you’re looking to buy in Montreal, don’t miss our neighborhood fact sheets to learn all about each of the city’s neighborhoods!

Established neighborhoods: the security of a stable investment

Historic or already well-developed neighborhoods, often close to the city center, offer investors a high degree of security. These areas attract affluent customers, benefit from strong rental demand, and generally boast high occupancy rates.

However, these neighborhoods can be overpriced, with higher purchase prices and gross rental yields sometimes lower than in developing neighborhoods. Despite this, they guarantee stable value and constant demand, even during economic downturns.

“A good neighborhood is a balance between accessibility, infrastructure and quality of life. “A good neighborhood is a balance between accessibility, infrastructure and quality of life.“

Valérie Lacasse, leader in real estate

Essential criteria for choosing a neighborhood

To judge the attractiveness of a neighborhood, here are the points to analyze:

- Accessibility: Close to public transport, main roads, bike paths.

- Amenities: Schools, shops, health services and green spaces.

- Safety: A safe neighborhood attracts more families and long-term tenants.

- Atmosphere and resident profile: A student, family or mixed neighborhood will have different rental demand and price dynamics.

- Ongoing projects: Urban renewal, new public services or cultural spaces are positive signals.

The location of the property for your future comfort and added value

A property’s location is more than just the city or neighborhood: its exact location also plays a crucial role. This factor has a direct impact on residents’ quality of life, accessibility and the perceived value of the property. Even in a sought-after neighborhood, a poorly chosen location can reduce a property’s appeal.

Close to amenities and services

A property located within walking distance of essential amenities (shops, schools, hospitals) will always be more sought-after. This proximity guarantees convenient, pleasant living for residents.

– Families prefer properties close to schools, crèches and parks.

– Young professionals are looking for properties close to restaurants, cafés or business centers.

A property far from these services, even in an attractive neighborhood, is likely to attract fewer buyers or tenants.

Accessibility and transport

Proximity to public transport is a key criterion for buyers and investors. Properties located near subway stations, bus stops or train stations are generally in greater demand.

- Being less than 10 minutes’ walk from public transport is often seen as a major advantage.

- Conversely, a property with poor transport links or requiring long car journeys loses its appeal, particularly among the younger generation.

Road accessibility is also an important factor, especially for outlying areas, where proximity to major highways facilitates travel.

Nuisance exposure

Even in a well-located area, a property can lose value due to local nuisances:

- Industrial or commercial neighborhood with activities that may generate noise or odors.

- Proximity to noisy roads, railroads or airports.

- Regular or occasional events or bars nearby.

These factors can put off many buyers and tenants, especially families or the elderly looking for peace and quiet.

Immediate environment, safety and light exposure

The direct environment of a property is a crucial criterion influencing its attractiveness and value. The following elements are particularly important:

- Safety: A clean, well-lit street perceived as safe attracts more families and long-term tenants. Poorly maintained or unsafe areas can deter buyers, even if the overall neighborhood is popular.

- Brightness and orientation: A property with a southern or western exposure benefits from abundant natural light throughout the day, making it more pleasant to live in and economically attractive thanks to lower energy costs. On the other hand, a northerly orientation or an environment that is too enclosed (nearby buildings, narrow streets) can be detrimental to occupants’ quality of life.

- Views and surroundings: Properties with an unobstructed view of a park, square or natural area offer a pleasant living environment that enhances the value of the property. Conversely, a property overlooking a parking lot, an industrial building or a very noisy street can lose its appeal, even if it’s well located in the neighborhood.

A balance between these factors ensures an optimal residential experience, while increasing the perceived value of the property for future resale or rental.

Conclusion

Location is undoubtedly the most decisive factor in the success of any real estate project. Whether it’s the choice of city, neighborhood or even the exact location of the property, each decision has a direct impact on rental demand, ease of resale and long-term value enhancement.

A strategic location not only guarantees a superior quality of life, but also financial security and constant appreciation potential. Investing in a well-located property, close to amenities and transport, and offering a secure, bright environment, ensures solid returns and peace of mind, even in a more uncertain market.

Take the time to evaluate every aspect of the location before making a commitment. With rigorous analysis and a clear vision, you can turn your real estate project into a lasting, profitable success.

To make your real estate project a reality, put your trust in our team of real estate brokers in Montreal.

Valérie Lacasse

Valérie has been a real estate broker for over 10 years. Passionate about the industry and Montreal, she is one of Montreal’s most influential brokers, guaranteeing expertise and comprehensive support to her clients.

Our blog posts are full of tips and information about real estate in Montreal!

- Montréal real estate market: How high will prices go?

- Town of Mount Royal events this summer

- Real estate Montréal : Real estate market statistics May 2025

- Do Open Houses Still Work in the Age of Virtual Tours?

- Montréal real estate market: everything you need to know about Airbnb short-term rentals

- High-season real estate sales strategy