When to buy in the 2024 real estate market

When to buy in the 2024 real estate market

With 2024 on the horizon, the Montreal real estate market is at an exciting inflection point. With interest rates stabilized by the Bank of Canada and buyer confidence on the rise, we are witnessing a promising market dynamic.

Initial data for January already show an increase in sales compared with the previous year, suggesting a positive year for the sector. But when exactly is it worth buying in Montréal in 2024?

This article dives deep into seasonal trends, price forecasts and buying strategies to reveal the optimal time to take the plunge into real estate buying. Whether you’re a novice looking for your first home or a seasoned investor, this article is your indispensable guide to navigating the Montreal real estate landscape of 2024.

Table of contents :

- 2024 Montréal real estate market: when to buy

- Analysis of real estate market trends in Montreal

- Montreal real estate market price forecasts

- Key factors influencing the Montreal real estate market

- Impact of interest rates on real estate

- Influence of the economy on the real estate market

- Location and types of property sought

- Buying guide for future homeowners in Montreal

- Negotiating a low-cost mortgage

- Identifying the right time to buy a property

- Opportunities for investors and real estate buyers 2024

- Montreal advantages for real estate investment

- Tips for first-time real estate buyers in montreal

- Purchasing strategy

2024 Montréal real estate market: when to buy

Timing is everything when it comes to investing in real estate, especially in Montreal where the market is subject to significant fluctuations.

In 2024, Montreal looks like fertile ground for buyers, with promising forecasts. We unravel the key moments for investing, based on an analysis of current trends and price forecasts.

Analysis of real estate market trends in Montreal

The year 2023 was marked by a market affected by a tense macro-economic context worldwide. After suffering the economic shocks and instabilities (high interest rates, housing crisis…), many were predicting a difficult 2024 for the sector.

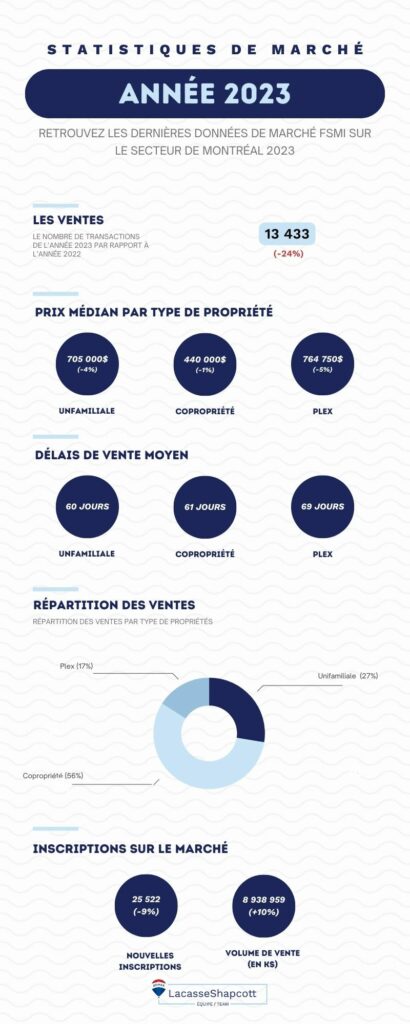

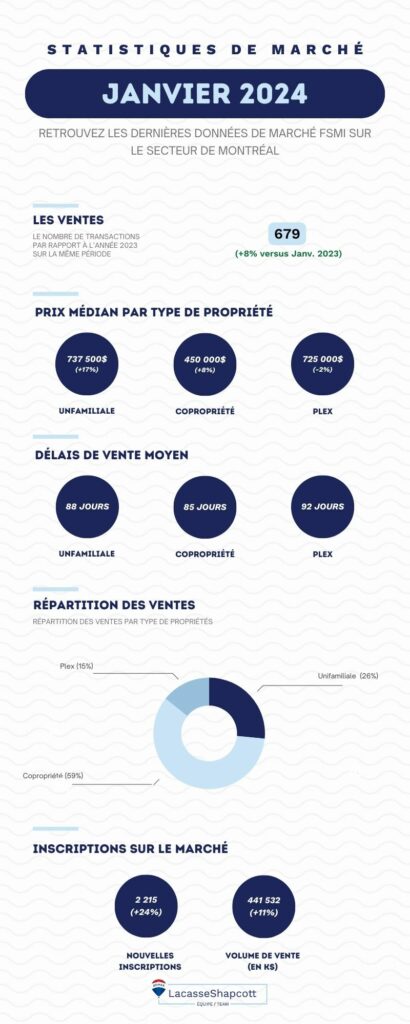

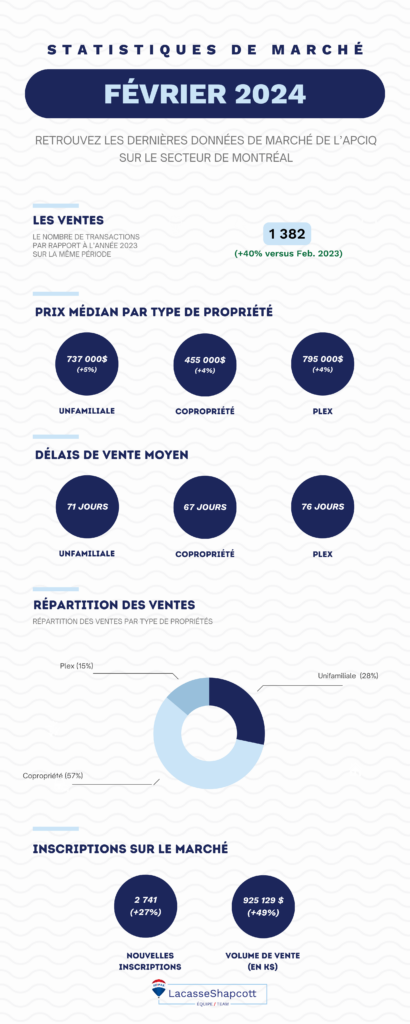

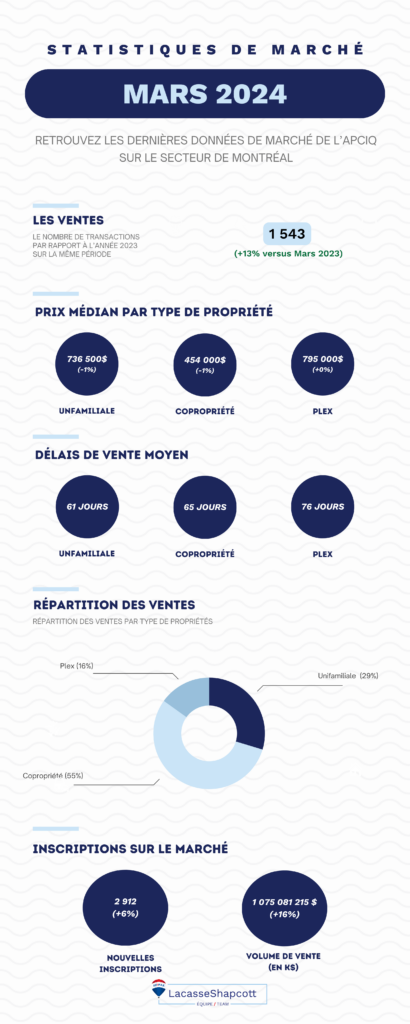

However, since the last quarter of 2023, we have seen signs of recovery in the market, which seems to have weathered the shocks of 2023 and is ready to get back on the growth track. At least, that’s what the latest market data for January 2024 show, with rising sales and positive growth indicators.

Since the beginning of 2024:

- Return of buyer confidence: After a period of uncertainty, the beginning of 2024 marks a notable return of confidence among buyers, thanks to the stability of interest rates maintained by the Bank of Canada.

- Increase in sales volume: Preliminary data indicate an increase in sales of around 8% in January compared with the same period last year, testifying to a dynamic market.

- Other positive signals to consider:

- Stable interest rates favor buyers.

- Volatility of government bond yields declining.

- Rates for five-year mortgages fixed at around 5%.

These elements converge to create an environment conducive to buying, especially for those who act quickly to seize opportunities ahead of expectations of price rises.

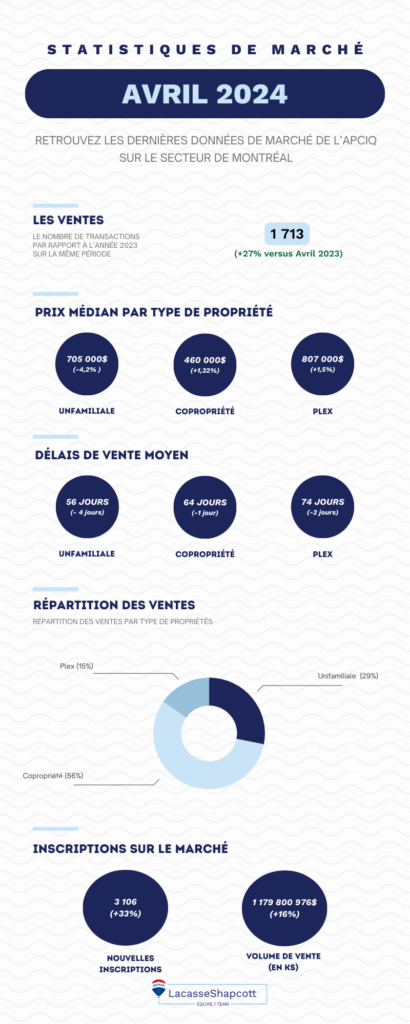

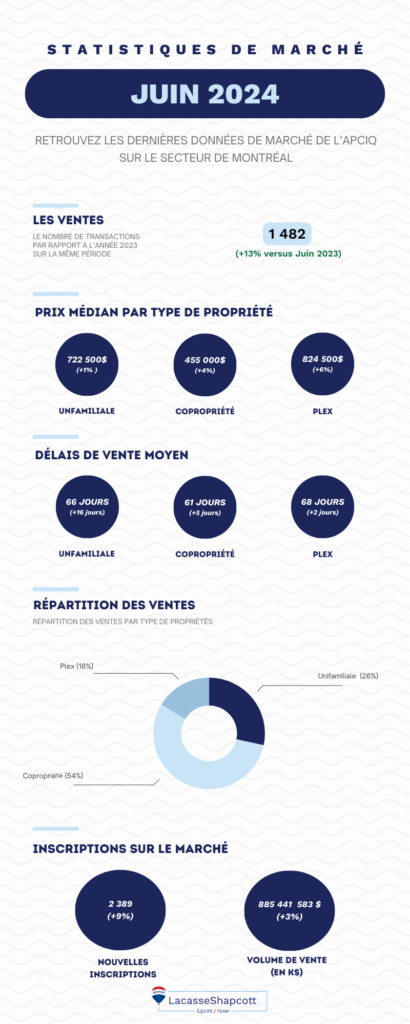

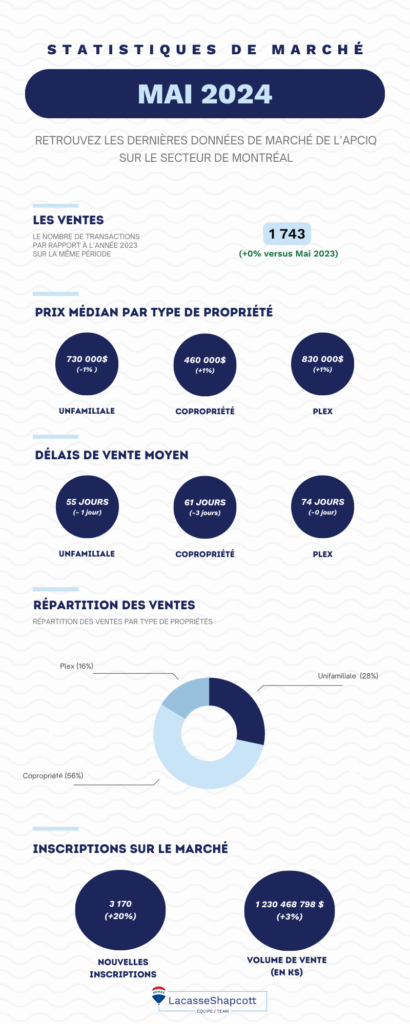

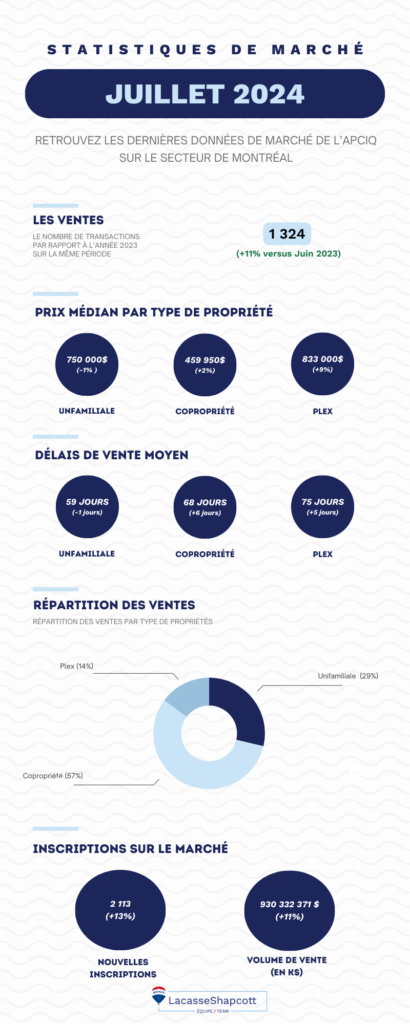

Every month, the Lacasse Shapcott team offers you detailed market analyses to help you navigate the real estate market:

- Montréal real estate market: How high will prices go?

- Do Open Houses Still Work in the Age of Virtual Tours?

- Montréal real estate market: everything you need to know about Airbnb short-term rentals

Montreal real estate market price forecasts

The year 2024 promises to be a turning point for the Montreal real estate market, with price forecasts on the rise:

- Expected price increases: Between 3% and 5% by year-end, offering a window of opportunity for buyers in the next 30 to 60 days.

- Factors influencing prices :

- Bank of Canada maintains interest rates.

- Greater availability of products on the market.

- A massive return of buyers means more competition for inventory and a natural rise in prices.

We’re already seeing a slight rise in prices for most property types in January 2024 (single-family homes, plexes, condominiums), and this trend could certainly continue as the months go by.

These forecasts underline the importance of swift action for buyers wishing to take advantage of current favourable conditions. The anticipation of rising prices over the summer is adding urgency for those looking to invest at a preferential rate, while securing competitive mortgage rates.

Get the latest market data via our infographics :

Key factors influencing the Montreal real estate market

The Montreal real estate market in 2024 is conditioned by several key factors, each playing a crucial role in purchasing decisions.

Understanding these elements can help buyers and investors navigate the real estate landscape wisely, identifying the best opportunities and avoiding potential pitfalls.

Impact of interest rates on real estate

The relationship between interest rates and the real estate market is inextricably linked. Interest rates condition and determine the financing of a property for a buyer, and a small variation in interest rates can represent several thousand dollars for a buyer. That’s why it’s essential to compare the different rates offered by financial institutions and choose the most attractive one when making your purchase.

In 2024, this dynamic is particularly relevant to Montreal, and here’s why:

- Recent rate stability: The Bank of Canada has maintained its key rate, creating a favorable environment for buyers.

- Rates likely to fall further: Most economists expect rates to fall by summer 2024, making it even easier for buyers to finance their property.

- Consequences for buyers :

- Five-year fixed-rate mortgages around 5% or less make buying more affordable for a buyer.

- Prompt action can secure advantageous financing terms and high-potential properties ahead of anticipated price rises.

The decision to buy in this context largely depends on future rate trends, underlining the importance of constant monitoring and responsiveness to market signals.

We have dedicated an article to this subject:

Influence of the economy on the real estate market

The economy plays a key role in the health of the real estate market.

In Montreal, local and global economic factors converge to influence prices and demand:

- Economic growth: A robust economy boosts buyer confidence and demand for real estate.

- Foreign investment: International investment flows can push up prices, particularly in desirable areas.

- Urban development project: Projects and major works undertaken by the city to improve its infrastructure and quality of life.

- Quality of life and city renown: city’s quality of life, as well as its distinctions and rankings, are key factors in determining its attractiveness.

Buyers need to be aware of economic trends and these factors to anticipate market movements and act accordingly.

Recent information and decisions taken by the city in recent years are in line with these elements, confirming Montreal’s attractiveness for real estate investment and making it a prime location.

Location and types of property sought

Location remains one of the most decisive factors in real estate value.

For the three main property types: single-family homes, plexes and condominiums, location, market position and property features are key factors in determining a property’s attractiveness.

In Montreal, current trends highlight :

- Trendy neighborhoods still attractive: Montreal’s central districts are still extremely attractive, and their prices continue to rise.

- Growing suburbs: There’s a growing trend towards towns and suburbs on the outskirts of the city, attracting more and more families.

- Preferred property types :

- Modern condos for their ease of maintenance and strategic location.

- Single-family homes for the space and tranquility they offer.

- High-potential properties :

- Those that have been on the market for a long time are more likely to offer trading opportunities.

- Those in urgent sales situations present negotiating advantages for buyers.

- A property’s features and equipment determine its real value, as well as its potential for development or optimization.

Selecting the right neighborhood and the right type of property for your needs is essential to a successful investment in Montreal.

To discover the characteristics and real estate data of Montreal’s different neighborhoods, discover our neighborhood fact sheets :

Buying guide for future homeowners in Montreal

Montreal’s real estate market in 2024 is rich in opportunities, especially right now. But it requires a thoughtful approach to maximize your investment. Whether you’re a first-time buyer or a seasoned investor, understanding the nuances of the market and adopting a relevant strategy is essential.

Our team has developed a strategy that allows buyers to save thousands of dollars on their loan and mortgage and make a highly profitable investment in the market: Discover the complete guide.

Here are some key elements to consider in your purchasing strategy.

Negotiating a low-cost mortgage

Obtaining an advantageous mortgage is crucial in the real estate buying process. Here’s how you can save substantially:

- Compare mortgage rates: Quebec’s financial institutions offer competitive rates, especially until the summer, a key period for relocating.

- Anticipate rate cuts: With the Bank of Canada expected to lower its key interest rate, negotiate your rate around 30 days before you sign at the notary’s office, for significant savings.

- Immediate and long-term benefits:

- Short-term: Savings from locking in rates at favorable conditions.

- Obtaining a property at a low price

- Long-term: Increase the value of your property in a growing market.

- Short-term: Savings from locking in rates at favorable conditions.

Identifying the right time to buy a property

The right time to buy greatly influences the success of your real estate investment:

- Targeting the purchase: The current period, until summer 2024, is ideal for taking advantage of low market prices and positioning yourself on an undervalued property before market growth resumes.

- Buyers strategy :

- Take advantage of current conditions to secure a property at a competitive price.

- Negotiate the best mortgage rate just before closing to maximize savings.

This strategic approach, based on in-depth market analysis and an understanding of economic dynamics, ensures that you benefit from the best possible conditions, both in terms of purchase price and financing.

Find out more about the winning purchasing process in an infographic:

Opportunities for investors and real estate buyers 2024

With 2024 shaping up to be a pivotal year for the Montreal real estate market, opportunities abound for those ready to plunge into the real estate adventure. Whether you’re a seasoned investor or a first-time buyer, Montréal offers fertile ground for sound, profitable investments.

Discover in video why the current period is a unique opportunity on the market:

Montreal advantages for real estate investment

Montreal stands out for its resilience and growth potential, unique in the Canadian real estate landscape.

Kyle Shapcott

There are many reasons to invest in Montréal:

- Economic dynamism: The city benefits from a strong, diversified economy, fostering a constant demand for housing.

- Quality of life: Renowned for its quality of life, Montreal attracts new residents every year, increasing demand for residential properties.

- Potential for added value: With prices expected to rise by between 3% and 5% between now and the end of the year, investments made now promise attractive returns.

Tips for first-time real estate buyers Montreal

Tips for first-time real estate buyers Montreal

- Ask the right questions: Before you commit, ask your broker about current market trends, growth forecasts and developing neighborhoods.

- Ask the right questions:Understanding the market: Learn about the specifics of the Montreal market, such as seasonal fluctuations and the impact of local policies on real estate.

- Mortgage pre-approval: Make sure you get pre-approved before you start your search, to know your purchasing capacity.

Your real estate broker must be at your side for each of these steps and more. To make sure you make the best investment, let the best team of Montreal real estate brokers accompany you.

Before committing to a purchase, consult our investment guide.

Purchasing strategy

The purchasing strategy for 2024 is based on intelligent anticipation and timely action. As Kyle explains in his video, “The beginning of 2024 is the ideal time to position yourself, taking advantage of the still-favorable interest rates and competitive market prices.”

- Anticipate trends: Act on anticipated interest rate movements and market forecasts to maximize your savings and growth potential.

- Choosing the right time and the right property: Buying an undervalued property at the right time can turn into a highly profitable operation in the medium and long term.

- Negotiation and financing: Negotiate the best possible rate before signing at the notary’s office, which could result in significant savings over the term of your mortgage.

Conclusion

With rates for five-year mortgages hovering around 5% and indicators pointing to an active spring season, the opportunity is as tangible as ever. Thanks to current market conditions, you can make a highly profitable investment right now and acquire the property of your dreams at the best price, while saving thousands of dollars on financing.

Clearly, this year promises to be rich in opportunities for investors and first-time buyers. The keys to success in this environment are preparation, information and strategic action. Whether you’re looking to buy your first home or expand your real estate portfolio, Montreal offers an exceptional playground for those ready to make informed decisions.

The Lacasse Shapcott team is on hand to guide you through the process, offering local expertise and personalized advice to turn your real estate goals into reality.