Montreal 2024 real estate investment guide

Montreal 2024 real estate investment guide

Investing in Montreal real estate is not something you can improvise. In such a dynamic and competitive market, strategic guidance is essential.

This real estate investment guide is designed to help you navigate the complexities of the Montreal market, offering you a proven strategy for maximizing your return on investment. Whether you’re a beginner looking to make your first purchase, or an experienced investor looking to expand your portfolio, this guide is your compass in the world of Montreal real estate.

Let’s see this in details :

- Successful real estate purchasing strategy in 2024

- Evaluate your real estate investment capacity

- Evaluate your real estate investment capacity

- Estimating additional costs

- Selecting the ideal Montreal neighborhood

- Analyze market data

- Identifying growth potential

- Find potential properties in Montreal

- Use real estate alerts

- Recognizing opportunities

- Real estate negotiation strategies

- Understanding market dynamics

- Timing of purchase

- Finalizing your real estate investment

- Revaluation of mortgage rates

- Importance of Notarial Choice

Successful real estate purchasing strategy in 2024

2024 is a year full of real estate opportunities. After a rather balanced 2023, the market is showing significant signs of recovery, and this is translating into unique opportunities on the real estate market.

To take advantage of the current context, the purchasing strategy consists of :

- Identify the ideal property from the rich inventory on the market

- Lock in an attractive mortgage rate 30 days before going to the notary’s office

- Activate this new rate when signing

- You’ll save thousands of dollars and get a quick return on your investment.

To understand in detail the strategy to adopt, you can consult our last article on this subject:

Let’s move on to the steps involved in implementing this strategy.

Evaluate your investment capacity

Before diving into the Montreal real estate market, it’s crucial to assess your financial capacity. This analysis will determine which property you can position yourself for.

The first step is mortgage pre-approval, which gives you a clear idea of your budget and secures your position as a serious buyer. In addition to the purchase price, don’t forget to calculate additional costs: welcome tax, inspections, notary fees, etc.

To do this, you need :

- Connect with mortgage specialists for pre-approval

- List ancillary expenses

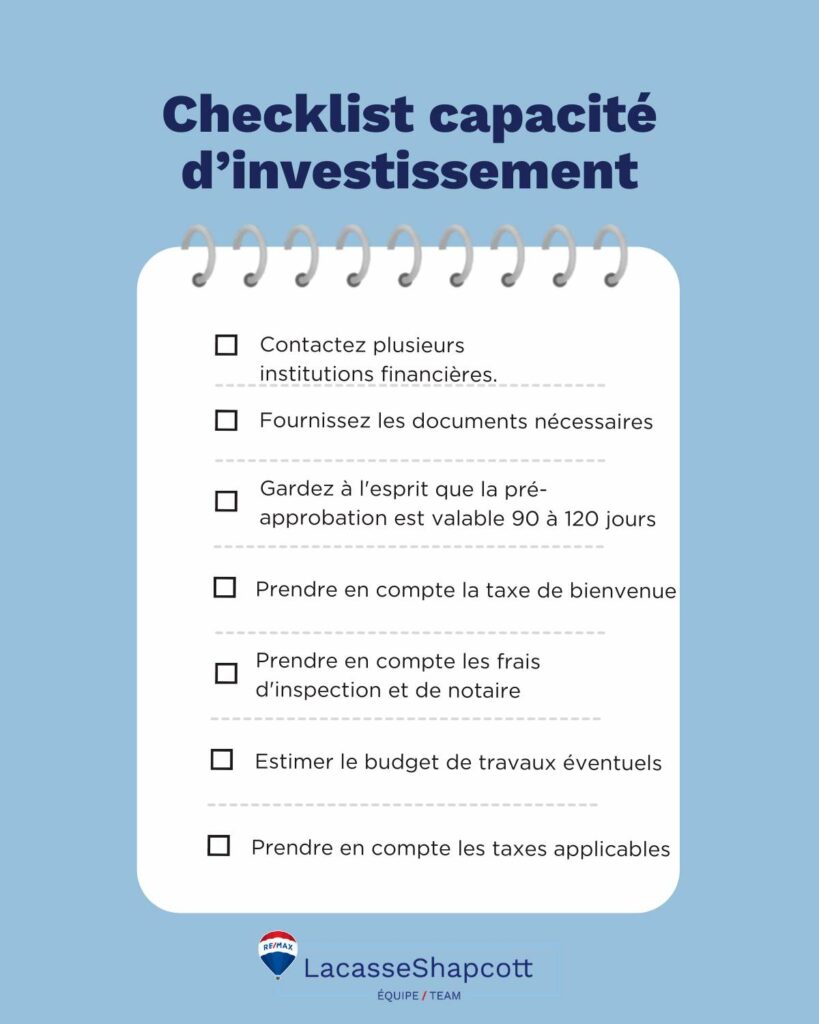

We offer you the checklist for this:

Evaluate your real estate investment capacity

Mortgage pre-approval is your first step toward a successful real estate investment in Montreal.

It allows you to clearly define your budget and show sellers that you are a serious and ready buyer. Here’s how it works:

- Contact several financial institutions to compare offers.

- Provide the documents needed to accurately assess your borrowing capacity.

- Bear in mind that pre-approval is often valid for 90 to 120 days; plan your search accordingly.

Estimating additional costs

Beyond the purchase price of the property, several additional costs must be taken into account:

- Welcome tax: calculated as a percentage of the purchase price.

- Inspection costs: essential to avoid future unforeseen expenses.

- Notary fees: required to validate and register the transaction.

- Potential work: An envelope for any work to be carried out on the property

- Taxes or other federal or government spending.

Understanding and taking into account all these costs will enable you to have a budget that is carefully evaluated and true to your investment capacity.

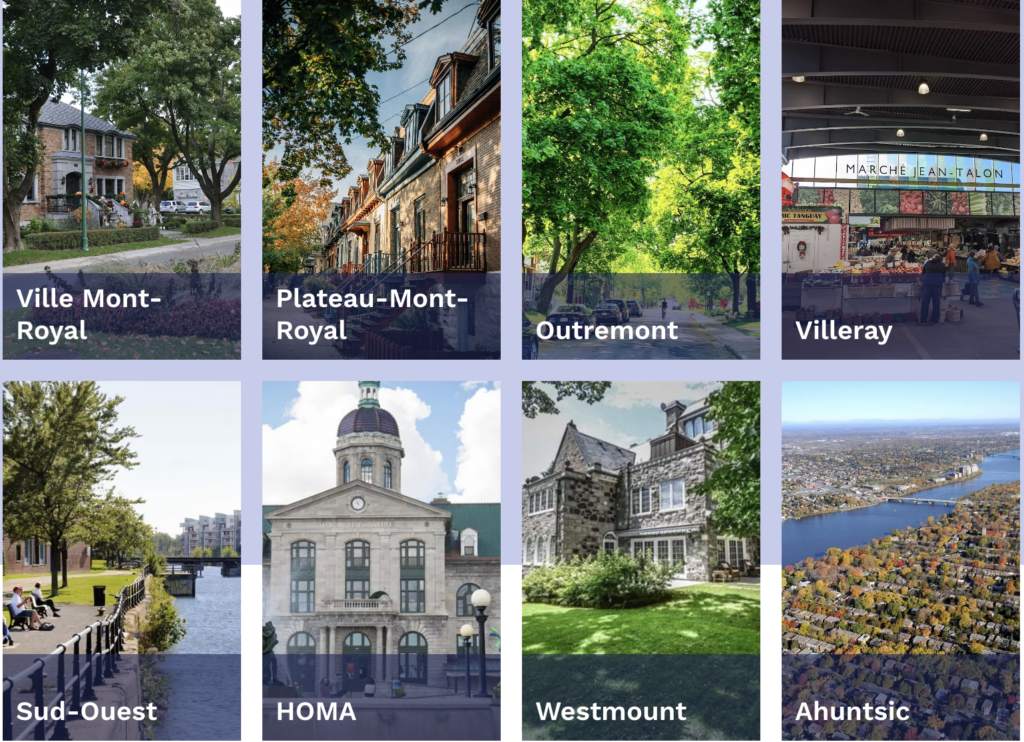

Selecting the ideal Montreal neighborhood

Neighborhood selection is a second fundamental aspect of your investment strategy. Analyze recent market data to understand sales trends, average prices, and time-to-market. Then look for neighborhoods with growth potential, where the investment can improve over time.

- Data-driven selection criteria

- Areas with high value-added potential

Our neighborhood fact sheets can help you choose the best neighborhood for you!

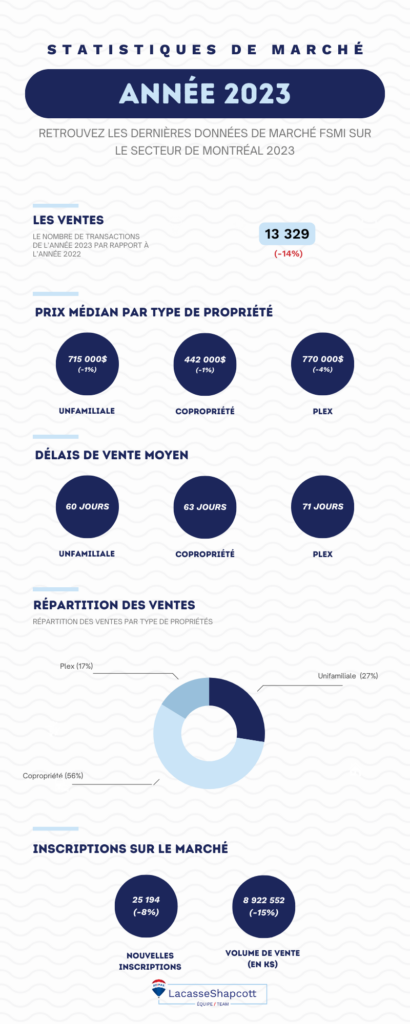

Analyze market data

Analyzing market data is the key to choosing the right neighborhood.

Please note :

- Recent sales trends to identify growing neighborhoods.

- Average prices and days on market to understand local dynamics.

- Urban development forecasts that may influence the future value of your investment.

Here is a recap of market data in 2023 to help you in your research:

Identifying growth potential

Look for neighborhoods with high growth potential, considering :

- Infrastructure projects planned for the region.

- The evolution of communities and the arrival of new services and businesses.

- Demographic growth statistics point to growing demand.

Find properties in Montreal

Now we come to the most interesting stage: finding the best properties. Montreal is a city full of opportunities, but expert guidance is essential to find the best deals, so contact our montreal real estate brokerage agency.

Use real estate alerts

With real estate alerts, stay on top of new listings that match your criteria. Learn to identify undervalued properties or those that have been on the market for a long time, as they may offer better negotiating conditions.

- Set up alerts for real-time updates

- Keys to recognizing a bargain

In addition to the alerts, your real estate broker can provide you with a weekly or monthly market report to present you with opportunities.

Find properties with high potential

To identify the best deals, focus on :

- Properties requiring renovation can be negotiated at a lower price.

- Urgent sales, where sellers are more open to negotiation.

- Properties that have been on the market for a long time may hide advantageous negotiation opportunities.

Of course, you need to feel comfortable with the properties you visit and see a significant opportunity before making your choice.

Visit our property page to find out about the latest properties for sale in Montreal.

Real estate negotiation strategies

Understanding the dynamics of the local market is essential to effective negotiation. The timing of your purchase can also influence the final deal, especially in a market as volatile as Montreal’s.

- Negotiation techniques adapted to Montreal

- The importance of agility in your purchasing decisions

We talk about it in an article:

Understanding market dynamics

To make the right choice and be sure of entering the market at the right time, it’s essential to analyze market trends.

Understanding market dynamics helps you to :

- Seize the best time to buy, based on supply and demand.

- Negotiate price based on current and future market trends.

We regularly analyze market statistics and trends in our articles:

- 2023 back to reality

- 2024 real estate buying strategy

- A further rise in the interest rate and the Bank of Canada’s forecast

Timing of purchase

As the final step in your negotiation strategy, timing is key to making the best possible investment.

Timing can significantly influence your investment:

- Buying during slow periods can offer more negotiable options.

- Anticipate market trends to buy before price rises.

Finalizing the investment

Once the offer has been accepted, it’s time to reassess the mortgage rate. A Bank of Canada interest rate adjustment may work in your favor. The choice of notary is also crucial, as it can influence the speed and efficiency with which the sale is completed.

- Rate monitoring for potential savings

- Selecting a notary experienced in real estate transactions

This is where strategy comes into play, saving you thousands of dollars.

Reassess your mortgage

Once the offer has been accepted, it is crucial to :

- Monitor changes in interest rates for potential renegotiation of your loan.

- Keep an eye on changes in interest rates for a potential renegotiation of your loan.a

- Consult your mortgage specialist again to adjust your loan to the best available rates.

This step is crucial to negotiating the best loan and saving thousands of dollars.

The importance of choosing a notary

Choosing an experienced notary is crucial:

- Look for a notary specialized in real estate for a smooth transaction.

- Consider the recommendations of your network when choosing a trusted professional.

If you wish, our team can refer you to appropriate and competent notaries.

Find out more about the strategy in our infographic :

Conclusion

Navigating the Montreal real estate market requires a well-defined strategy and careful preparation. By following the real estate investment guide presented here, you’ll be equipped with the knowledge and tools you need to make informed choices and optimize your investment. For the best real estate investments, contact our team.