Montreal real estate market – Analysis and trends

Montreal real estate market – Analysis and trends

Update on: 10 Juillet 2024

Reading time: 10 minutes.

Table of contents :

- Real estate market analysis 2023 – 2024

State of the real estate market 2023

Real estate statistics January 2024

Real estate statistics February 2024

Real estate statistics March 2024

Real estate statistics April 2024

Real estate statistics May 2024

Real estate statistics June 2024 - 2024 real estate market forecasts

Real estate market outlook in 2024

Property price forecasts 2024

Real estate market players - How property prices will evolve in 2024

Will the real estate market decline in 2024?

How much will real estate prices rise in 2024?

Outlook and forecasts for real estate prices in 2024 - Montréal 2024 real estate: Housing demand and supply

Property types and trends

Current neighborhoods and urban development

As we enter February 2024, the Montreal real estate market remains a dynamic landscape, shaped by a variety of factors such as economic conditions, housing demand and policy changes.

In this article, we examine the current state of the Montreal real estate market, exploring key trends and providing valuable information for buyers and sellers alike.

Key facts:

- Montreal’s real estate market in 2023 showed remarkable resilience, growing despite economic and geopolitical challenges.

- January 2024 saw a recovery in real estate sales in Montreal, spurred by lower mortgage interest rates, with the average selling price of homes rising to $570,220.

- Experts anticipate a mixed real estate market in 2024 in Montreal, with the first half of the year under pressure and a recovery expected in the second half thanks to lower interest rates.

- New arrivals and out-of-province migration continue to positively influence housing demand in Montreal, despite affordability challenges for first-time buyers.

- Forecasts for 2024 suggest stable real estate prices around $411,300, with a slight increase expected in some Montreal neighborhoods, reflecting continued demand and the city’s attractiveness.

Real estate market analysis 2023

Montreal’s real estate market remained resilient, showing some growth despite external uncertainties.

According to recent data, real estate values rose moderately despite a fall in sales, signalling a positive trend for homeowners and investors. This growth is attributed to a combination of factors, including future low interest rates, a stable economy and the attractiveness of Montreal as a place to live and work.

State of the real estate market 2023

The year 2023 ended with a degree of market stability.

We can see that the market has proved resilient despite tense macro-economic conditions. In fact, despite a number of alarming factors, the market ended up virtually balanced.

Although this is not a positive trend in itself, in view of the factors impacting the market we can see good health and resilience in the market, which has been able to withstand external pressures, namely :

- A marked housing crisis in Canada.

- High interest rates in 2023.

- A limited inventory.

- Pesky geopolitical uncertainty.

These factors, which are penalizing the real estate market, have been fairly well absorbed by the Montreal sector, which has managed to maintain its equilibrium despite these shocks.

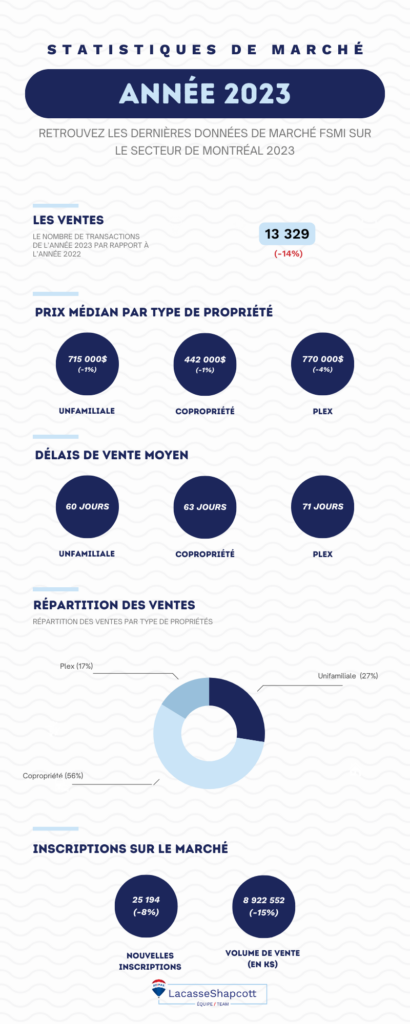

Discover the 2023 statistics at a glance with our infographic :

Real estate statistics January 2024

In January 2024, the Montreal real estate market showed a remarkable evolution, marked by a notable recovery and an adaptation to economic conditions and monetary policies. Here is a detailed statistical analysis:

- Sales upturn: Despite a performance below the historical average for January, sales were up significantly on the previous year.

This positive trend is largely due to the recent fall in mortgage interest rates, which has revitalized the market and stimulated buying activity.

- Price adjustment: The average selling price of homes in Montreal reached $570,220 in January 2024, reflecting annual growth of 7.8%.However, the average price has climbed 40% since January 2020 according to wowa.ca, highlighting significant property appreciation.

(Wowa.ca)

- Transactions and inventory: With 2,077 homes sold, transaction volume was up 16% year-on-year, although slightly down on the previous month. Available inventory followed suit, up 16% on the previous year, indicating an increasingly balanced market.

- Performance by property type :

- Single-family homes: Median price stable at $535,000, up 7% year-on-year.

- Condominiums: Median price of $390,000, up 5.4% year-on-year.

- Plex: Median price reaches $722,500, up 7% year-on-year.

- Impact of interest rates: The earlier rise in interest rates had slowed housing demand. Expectations of lower interest rates in 2024 initially supported the market. Current forecasts anticipate lower rates in the second quarter of 2024, which could boost interest in property purchases.

In summary, the dynamics of the Montreal real estate market in January 2024 reflect the complexity inherent in economic fluctuations and policy adjustments. However, the market is also showing remarkable resilience and a positive outlook for the future. Signs of recovery, such as increased sales and prices adjusting to stable levels, suggest renewed consumer confidence and market adaptability in the face of challenges.

The anticipation of lower mortgage interest rates, supported by current forecasts, promises to further stimulate market activity, offering opportunities for both buyers and sellers.

Real estate statistics February 2024

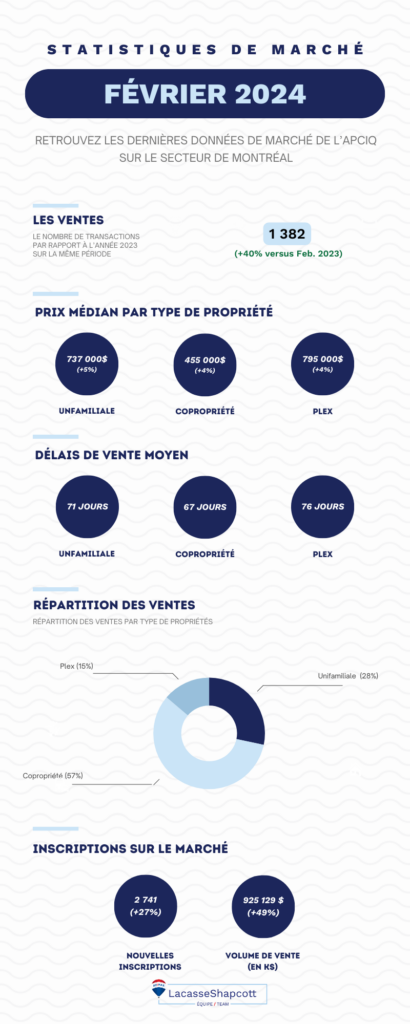

Montreal real estate market statistics for the month of February show positive signs for the market, confirming the growth that many analysts are anticipating:

Analysis of real estate statistics February 2024

Real estate statistics for February 2024 offer some very interesting signals about economic health and market trends:

- +40% sales vs. February 2023: This significant increase in sales demonstrates a strong recovery in the real estate market as early as February, when it was more likely to be expected with the arrival of spring. This increase shows that buyers are returning to the market, while sellers remain in a strong position.

- +4/5% rise in median prices: The rise in median prices is already noticeable in February, as many analysts were predicting. This increase should lead the real estate market to stable and sustainable growth by the end of the year.

- +49% in sales volume and +27% in new listings: These significant increases demonstrate an acceleration in the market, which is regaining its economic dynamism after several periods of turbulence since 2020.

Consult the complete analysis of real estate statistics for February 2024.

Real estate statistics March 2024

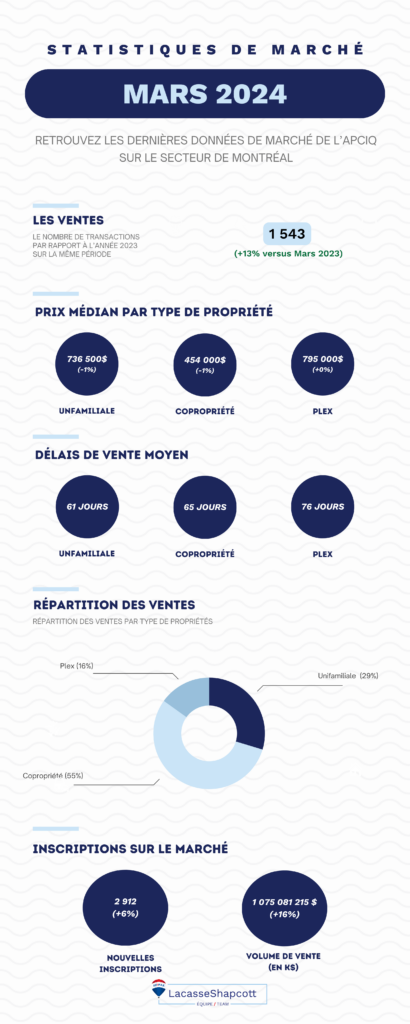

In March, the real estate market continued to grow, confirming the optimism prevailing on the market.

Analysis of real estate statistics March 2024

The real estate statistics for March 2024 demonstrate the good economic health and market trends:

- +13% sales vs. March 2023: This significant increase in sales continues, demonstrating the strong recovery of the real estate market in 2024.

- Stabilization of median prices: The stabilization of median prices shows that the market is optimistic for both sellers and buyers preparing their summer real estate projects.

- +6% in sales volume and +16% in new listings: These significant increases demonstrate that the market is accelerating and regaining its economic momentum after a pivotal 2023.

View the complete analysis of real estate statistics for March 2024.

Real estate statistics April 2024

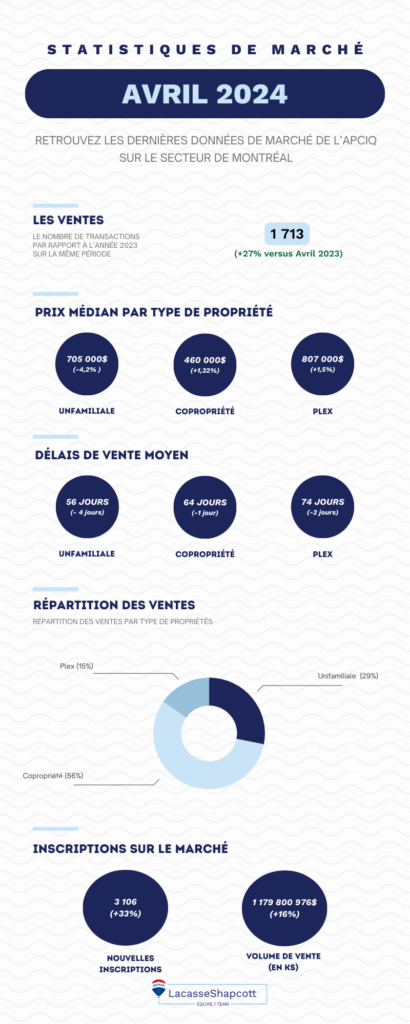

In April 2024, the real estate market continues to grow in terms of sales, with a reduction in time-to-market and a stabilization of median prices.

Analysis of real estate statistics April 2024

Real estate statistics for April 2024 confirm the market’s dynamic growth.

- +27% sales vs. March 2023: This significant increase in sales continues, demonstrating the healthy state of the real estate market in 2024.

- Stabilization/decrease in median prices: The stabilization of median prices demonstrates an acceptable psychological price for buyers, who seem to have come to terms with current rates to finance their projects.

- +33% in sales volume and +16% in new listings: These significant increases show that, despite the stabilization of prices, the market remains very dynamic and should continue to grow.

Discover the complet analysis of April 2024

This context offers a window of opportunity for those looking to invest in real estate or realize their dream of owning property in Montreal.

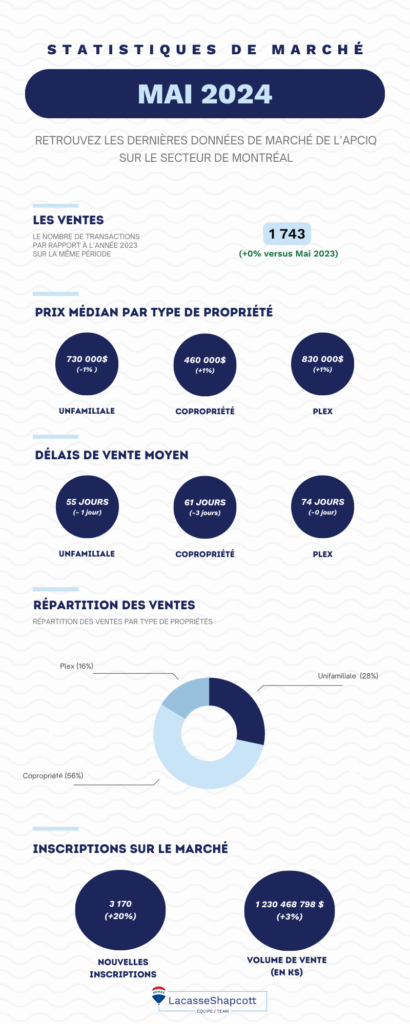

Real estate statistics May 2024

In May 2024, the real estate market is stabilizing in terms of sales, with a reduction in time-to-market and a stabilization of median prices.

Analysis of real estate statistics May 2024

Real estate statistics for May 2024 show that the market is stabilizing and continuing to grow, and remains attractive despite stable sales.

- +0% sales vs. May 2023: This stagnation seems logical in view of the latest increases observed, allowing the market to breathe a sigh of relief and balance itself out.

- Stabilization/decrease in median prices: The stabilization of median prices demonstrates an acceptable psychological price for buyers, who seem to have come to terms with current rates to finance their projects.

- +3% sales volume and +20% new listings: These significant increases in inventory point to a dynamic June on the market, which should continue to grow.

Discover the complete analysis of real estate statistics for May 2024.

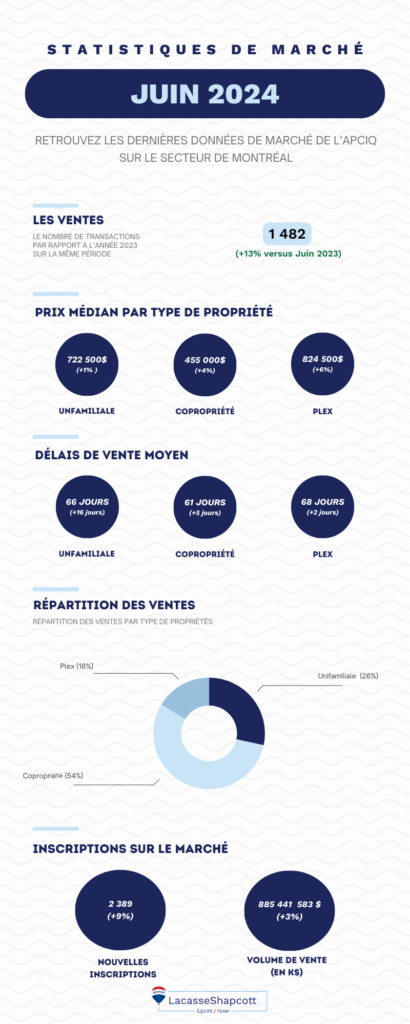

Real estate statistics June 2024

In June 2024, the real estate market accelerated with an increase in sales and inventory, encouraged by lower interest rates, the seasonality of the sector and housing policies that support demand and boost buyer confidence.

Analysis of real estate statistics June 2024

Real estate statistics for June 2024 show that the market continues to grow, attracting more and more players.

- +13% sales versus June 2023: This anticipated increase demonstrates the vitality of the sector, which has had an auspicious first half.

- Rising median prices: The return of buyers to the market has naturally boosted median prices. However, as soon as the first effects of housing policies are felt, prices should stabilize.

- +3% sales volume and +9% new listings: These significant increases in inventory augur well for a summer rich in supply on the market, which should continue to grow despite the historically weaker months in terms of activity.

Consult the complete analysis of real estate statistics for June 2024.

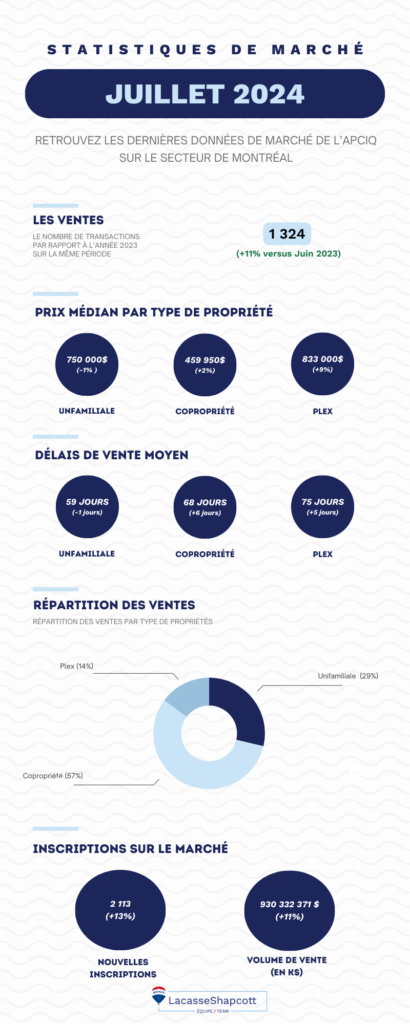

Real estate statistics July 2024

As of July 2024, the real estate market continues with the majority of indicators showing positive signs. Sales, inventory and sales volume have risen significantly, driven by buyer confidence and a macro-economic context that encourages the market.

Analysis of real estate statistics July 2024

Real estate statistics for July 2024 once again show that the market is continuing to grow, attracting more and more players.

- +11% sales vs. July 2023: This anticipated increase demonstrates the vitality of the sector, which has had an auspicious first half.

- Stabilization of median prices: The return of buyers to the market and the abundance of supply point to a stabilization of prices, already observed in recent months.

- +11% sales volume and +13% new listings: These significant increases in inventory demonstrate a very active market in which buyers and sellers seem to be consolidating their positions.

Consult the complete analysis of real estate statistics for June 2024.

Download our latest e-book to discover a unique buying strategy and save tens of thousands on your purchase and its financing.

Among others:

- How to win in today’s real estate market?

- Steps to a successful investment

- Analysis of key market facts and figures

2024 real estate market forecasts

Looking ahead to 2023 and the first month of 2024, initial analyses are encouraging for the current year, which should end with a growing market after an uncertain first half.

Prices are also expected to rise, and there are a number of different types of players on the market who should play a major role in the expected growth. Finally, we’ll try to answer questions about whether the real estate market will rise or fall in 2024.

Halfway through the year, the real estate market has exceeded expectations. With economic conditions becoming more flexible and market players increasingly confident, we’ve been seeing significant growth in the market for several months now.

Let’s take a closer look at these topics.

Property market outlook 2024

The year 2024 is shaping up to be a period of great importance for the Montreal real estate market, with forecasts indicating a year of contrasts, marked by a first half marked by major challenges and a second half that promises renewed activity and dynamism. In view of this early analysis, we can say that the market has surprised everyone, with growth statistics still on target.

Experts, such as the Association professionnelle des courtiers immobiliers du Québec (APCIQ), anticipate a moderate 2% decrease in the number of transactions, in stark contrast to the 33% drop from the record levels of 2022 (André Duluc, La presse). This relative slowdown testifies to the market’s resilience in the face of economic fluctuations and changes in interest rates.

The expected stability of prices, remaining at end-2023 levels of $411,300, is particularly remarkable given the spectacular 39% growth observed since 2020. This trend suggests an absorption of recent economic impacts and an adaptation of the market to prevailing conditions. The year 2024 could therefore be characterized by a market correction and consolidation, following years of sustained growth. Paradoxically, the statistics observed since the beginning of the year nevertheless show good vitality and growth in the market.

Interest rates, which are likely to remain high in the first half of the year, will play a crucial role in the initial slowdown in transactions. However, anticipated monetary easing could catalyze a recovery in real estate activity in the second half of the year, offering opportunities for both buyers and sellers. This dynamic highlights the market’s sensitivity to monetary policies and central bank decisions.

In this context, the Montreal market stands out for its specific behaviors. In Montreal, where the market remains largely in favor of sellers, a slight rise in prices is forecast, underlining the city’s continuing demand and economic vitality.

At the same time, immigration, with a significant number of new arrivals in 2023, will continue to have a positive influence on property demand, partially offsetting the effects of limited new construction. These new residents, looking for homes to buy, are injecting new energy into the resale market, exacerbated by rising wages and an unemployment rate that is expected to remain low.

On the other hand, this dynamic remains contrasted by an insufficient level of house and condo construction, pushing buyers towards the resale market. Lastly, positive wage trends and an unemployment rate that is set to remain low are helping to maintain solid demand.

In this landscape, risk factors such as the post-pandemic return to the office and affordability concerns for first-time buyers remain paramount. These factors will require continued vigilance on the part of market players to successfully navigate a changing environment. However, with the dynamics observed and the new market players, the sector’s momentum remains positive for the year ahead.

To successfully navigate the real estate market, put your trust in our team of Montreal real estate brokers.

Property price forecasts 2024

Experts, including those at the Association professionnelle des courtiers immobiliers du Québec (APCIQ), predict that property prices will remain at the levels observed at the end of 2023, i.e. around $411,300.

This forecast reflects remarkable price stability, despite significant economic challenges, and stands in stark contrast to the meteoric rise of 39% between 2020 and today.

This price consistency is all the more significant as it comes after a period of strong growth, illustrating the resilience of the real estate market in the face of interest rate variations and economic uncertainties.

The fact that prices are holding up suggests that, despite a potentially slower start to the year due to high interest rates, an upturn in activity is expected in the second half of the year, thanks to anticipated monetary easing. In a specific market such as Montreal, a slight increase in prices is forecast, with houses and condos likely to see their median prices rise by 2% and 1% respectively, reflecting strong demand and the metropolis’ continuing attractiveness.

In conclusion, forecasts for 2024 suggest a balanced and resilient real estate market, capable of adapting to economic challenges while offering attractive buying opportunities.

Get an overview of historical price trends at nesto.ca :

Real estate market players

The APCIQ emphasizes the importance of newcomers to a dynamic real estate market.

Here’s a look at the key players in the real estate market in 2024.

Multi-ownership investors

In 2024, the role of investors and timeshare owners will remain predominant, particularly in downtown Montreal, where their presence is particularly strong.

Representing over 16% of home buyers in Montreal in 2021, this category of investors continues to have a significant impact on the market, particularly in terms of the availability and price of residential properties. Their influence can also be seen in their ownership of a significant share of the housing stock, exacerbating affordability issues for first-time buyers.

First-time home buyers

For first-time buyers, access to property ownership in Montreal remains fraught with difficulties, due in part to high property tax rates compared to other major Canadian cities. Financial hurdles, such as the stress test and interest rates kept high by the Bank of Canada, make buying a first home particularly difficult without external financial support. This situation calls for additional measures to improve affordability and facilitate access to home ownership for new entrants to the market.

Affordability challenges, exacerbated by high interest rates and rising prices, are forcing these buyers to look for creative solutions to realize their real estate dreams. Help-to-buy programs, such as the first-time buyer incentive, play a crucial role, although their effectiveness is limited by persistent financial barriers.

Immigration and out-of-province migration

Immigration and out-of-province migration to Montreal continue to shape demand in the real estate market. With the federal government planning to welcome 2 million new immigrants to Canada, Montreal, with its cultural and economic appeal, is attracting a significant share of these new arrivals. This dynamic trend supports demand for both rental and purchase properties, contributing to the vitality and diversity of the local real estate market.

With over 109,000 new residents in the first half of 2023, immigration continues to support demand for homes. These new arrivals, with a purchase probability of over 50% for 3 out of 10 of them, play a crucial role in maintaining activity on the resale market, offsetting the slowdown in new construction.

In short, the year 2024 will see a complex interplay between different players in the Montreal real estate market. Understanding their respective influence and the challenges they face is essential to effectively navigating the city’s real estate landscape.

How property prices will evolve in 2024

The dynamics of the real estate market in 2024 are complex and influenced by multiple factors, from global economic trends to specific local policies.

Based on available information and expert forecasts, here’s how we can anticipate real estate price trends.

Will the real estate market decline in 2024?

The question of the real estate market’s decline in 2024 is nuanced and needs to be viewed through the prism of several key factors. Initially, it is essential to recognize that the market may be subject to varying pressures over the course of the year, directly influencing supply and demand dynamics.

- First half under pressure: Due to persistently high interest rates, the start of the year could be marked by a slowdown in transactions. This period of financial constraint could temporarily discourage potential buyers, putting downward pressure on prices.

- Anticipated recovery: An improvement is expected in the second half of the year. The expected easing of monetary policy, with a possible cut in interest rates, should revitalize the market. This transition to more favorable financing conditions could stabilize or even reverse the downward trend observed at the start of the year.

Among the specific factors influencing these dynamics, we identify :

- Affordability: A major challenge remains affordability, especially for first-time buyers. The steady rise in prices in recent years has restricted market access for this category of buyer, raising questions about the sustainability of price growth.

- Regulations on short-term rentals: Stricter regulations on rentals of less than 31 days could encourage owners to sell their properties. This measure is designed to increase the supply of available housing, which can slightly influence market dynamics.

- Mortgage shock: Homeowners facing mortgage renewals at higher rates may be forced to sell, adding supply to the market and underscoring the financial challenges for existing homeowners.

- New construction: The outlook for 2024 shows no significant signs of recovery. However, a slight increase in housing starts is expected, which could eventually help to balance the market.

The APCHQ forecasts around 46,000 new homes, up on 2023 estimates but still below previous levels.

This moderate increase in new construction, combined with short-term rental regulations and mortgage renewals, could have a significant impact on supply and demand.

How much will real estate prices rise in 2024?

To answer the question of how real estate prices will evolve in Montreal in 2024, it’s important to note that the real estate market, particularly in urban areas like Montreal, is influenced by a multitude of factors.

These factors include macroeconomic trends, monetary policies (notably interest rates), housing demand, available supply and region-specific dynamics.

Key factors influencing prices in Montreal

- Interest rates and monetary policy: The Bank of Canada regularly adjusts interest rates in response to economic conditions. An expected fall in interest rates in 2024, as some forecasts suggest, could stimulate the real estate market by reducing the cost of mortgage financing, thereby increasing consumers’ purchasing power and possibly driving up property prices.

- Dynamics of Supply and Demand: As a city that attracts immigrants, students and professionals, Montreal is experiencing a sustained demand for housing. This demand is accentuated by ongoing immigration and demographic growth.

If the supply of new homes fails to meet this growing demand, prices are likely to continue to rise. - Impact of the pandemic and telecommuting trends: Telecommuting trends are influencing housing demand, with a preference for larger spaces, often on the outskirts of urban centers. However, Montreal, as a business and cultural center, retains its attractiveness, which can support prices in specific market segments.

- Real estate investment and the rental market: Investors play a crucial role in the Montreal real estate market. Recent restrictions on foreign buyers and regulations on short-term rentals may influence investment and, consequently, prices. A robust rental market, combined with a limited supply of properties for sale, can also contribute to higher prices.

Price outlook and forecasts

According to Royal LePage, a significant increase in prices is expected in 2024, with growth of 5% to 6% for single-family properties and condos in Montreal, reflecting a recovery in the market after a quieter period.

At the same time, Soumissions Courtiers Immobiliers forecasts suggest a slight increase in prices due to an anticipated fall in interest rates and an overall economic recovery. They also indicate that price rises may not be uniform across all regions, underlining the importance of location in price dynamics.

We agree with this analysis of a likely future price increase in the Montreal area. While there are significant risks to the market, market conditions, its proven resilience and Montreal’s attractiveness remain factors that should lead to higher prices.

Montréal 2024 real estate: Housing demand and supply

One of the driving forces behind Montreal’s real estate success is the constant demand for housing. The city’s diverse neighborhoods, rich cultural diversity and thriving job market continue to attract a wide range of buyers. However, the challenge lies in meeting this demand with an adequate supply of housing.

In February 2024, the city is witnessing a balanced market, with a slight inclination towards a seller’s market in certain neighborhoods. Low inventory levels have led to heightened competition between buyers, making it crucial for future owners to act decisively and be prepared for potential bidding wars.

Property types and trends

By 2024, many factors, including demographic changes, technological developments and government policies, will shape the types of properties in demand and real estate trends in the metropolis.

Condominiums, single-family homes and duplexes remain popular choices among buyers. In recent months, there has been growing interest in sustainable and energy-efficient homes, reflecting a broader global trend towards ecologically conscious living.

Buyers are also showing a preference for properties with outdoor spaces, such as balconies or gardens, given that the importance of outdoor living spaces has been underlined by recent world events. Homes with dedicated office space remain popular, as remote working arrangements persist in many industries.

Condominiums and apartments

With the ever-increasing urban population and the search for affordable housing, condominiums and apartments remain popular choices, especially for first-time buyers and investors. The trend towards smaller, more efficient living spaces continues, as buyers prioritize location and convenience over large living spaces.

Single-family homes

Although the market for single-family homes remains strong, demand for these properties could be influenced by interest rates and credit availability. Families looking for more space and a quieter environment may prefer Montreal’s suburbs and suburban areas.

Green and sustainable properties

A growing awareness of environmental issues is prompting buyers to favor energy-efficient properties. New buildings tend to incorporate green technologies, such as solar panels, geothermal heating systems and sustainable building materials.

Technology and home automation

The integration of technology into residential properties continues to grow in popularity. Buyers are looking for homes equipped with home automation systems for security, comfort and energy efficiency.

Multifunctional spaces

The COVID-19 pandemic has accelerated the trend towards multifunctional homes that can accommodate telecommuting, distance learning and leisure activities. Buyers are looking for properties offering home offices, leisure space and gardens.

Here is a breakdown of property types since April 2020:

wowa.ca graphic

Current neighborhoods and urban development

Montreal’s real estate landscape will continue to evolve with the arrival of new infrastructure projects and the development of dynamic neighborhoods.

The Nouvel Outremont project is an emblematic example, marking the transformation of a former Canadian Pacific rail yard into a vibrant space including the Université de Montréal MIL Campus, over 1,300 housing units (30% of which are social and community housing), and the creation of new public spaces.

This indicates a strong commitment to housing diversification and improving residents’ quality of life. The completion of Avenue Thérèse-Lavoie-Roux, scheduled for 2020, is another example of this, highlighting the introduction of soft mobility infrastructure such as bicycle lanes.

The Griffintown area is particularly representative of this transformation, with large-scale real estate projects reinventing the urban landscape while drawing inspiration from the neighborhood’s rich historical heritage. The revitalization of rue Sainte-Catherine Ouest also illustrates this dynamic, offering one of the most dynamic commercial spaces in the world while improving public space for pedestrians.

These projects are just a few examples of initiatives to improve the housing supply and quality of life in Montreal. They reflect an ambitious vision of the future, in which urban planning and sustainable development are central concerns. These efforts are likely to attract more residents and investors to these booming neighborhoods, contributing to sustained demand in the real estate market.

To choose the neighbourhood that suits you best, consult our neighbourhood fact sheets:

Conclusion

As a result, 2024 looks set to be a positive year for the real estate market. If, as expected, economic conditions ease and inventory absorbs demand, we should see a year of growth or at least break-even.

All these factors need to be taken into account in your real estate projects. Navigating this exciting and ever-changing market is an adventure that requires a certain expertise and agility.

Let a real estate broker help you make your plans a success.

Read our latest articles full of advice and analysis: