Montréal Real Estate Statistics – April 2024

Montréal Real Estate Statistics – April 2024

What you need to know:

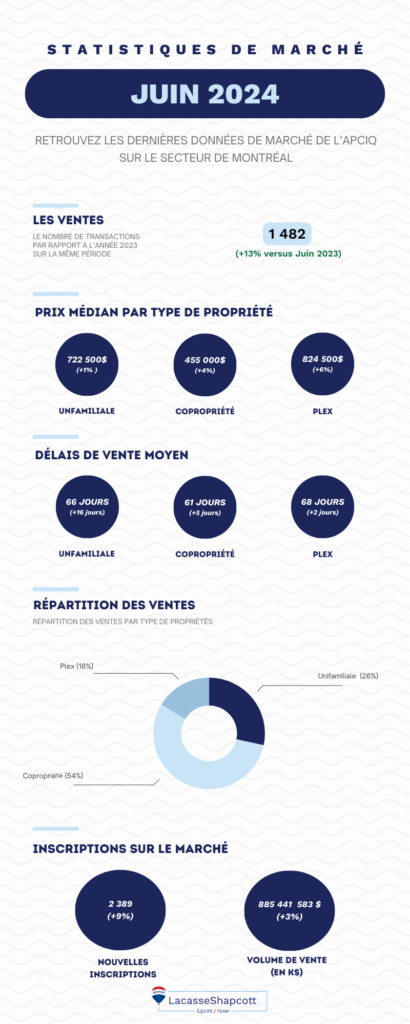

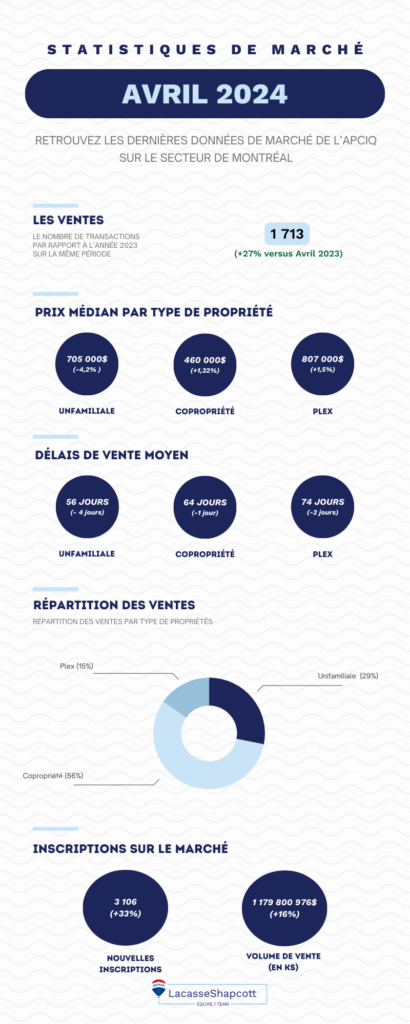

- Sustained growth in transactions: The real estate market recorded a 27% increase in sales compared with April 2023, with transaction volume reaching 1,713, indicating increased activity and renewed interest in real estate.

- Price stability: After significant increases at the start of the year, property prices in Montreal showed signs of stabilization in April, reflecting a more mature market.

- Shorter selling times: Sales times for the various property categories decreased, with single-family homes selling in an average of 56 days, testifying to the strength and agility of the market.

- Condominium dominance: Condominiums continued to account for the majority of transactions (56%), attracting a wide range of buyers thanks to their accessibility and diversity.

- Increase in listings: The number of new listings rose by 33% year-on-year, signaling optimism among sellers and anticipation of strong seasonal demand.

April 2024 marked a high point for the Montreal real estate market, with significant increases in almost all key indicators. The trends established earlier in the year continued, with notable adjustments in prices and a reduction in selling times, testifying to a dynamic market for both buyers and sellers.

Time needed: 5 minutes

- Montreal real estate market, April 2024

- Property prices in Montreal – April 2024

- Property sales Montreal – April 2024

- Breakdown of real estate sales Montreal – April 2024

- Registrations and sales volumes Montreal – April 2024

Montreal real estate market, April 2024

The Montreal real estate market in April 2024 continued to demonstrate its robustness and dynamism, capitalizing on an already strong start to the year. The momentum observed since the beginning of the year has been maintained, with statistics showing sustained growth in both transaction volumes and property values.

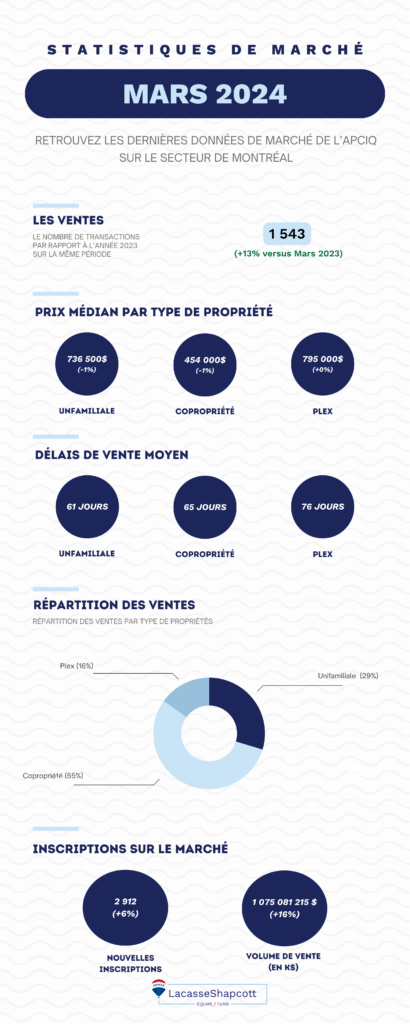

These figures testify to a market that is still growing, and that is continuing its good momentum of the beginning of the year. With sales up 27% on the same period in 2023, and 11% on last month. In terms of volume, sales reached 1,713 transactions this month (compared with 1,543 the previous month), reinforcing key market indicators and reassuring those still hesitating to invest in real estate before the summer…

The market’s upward trend can be explained in part by the stabilization of interest rates, the seasonal nature of the period, which is historically profitable for the market, and the approach of the summer season, as well as the resilience of the Canadian economy, all of which have a positive influence on the sector’s economic health.

Discover April’s real estate statistics in an infographic:

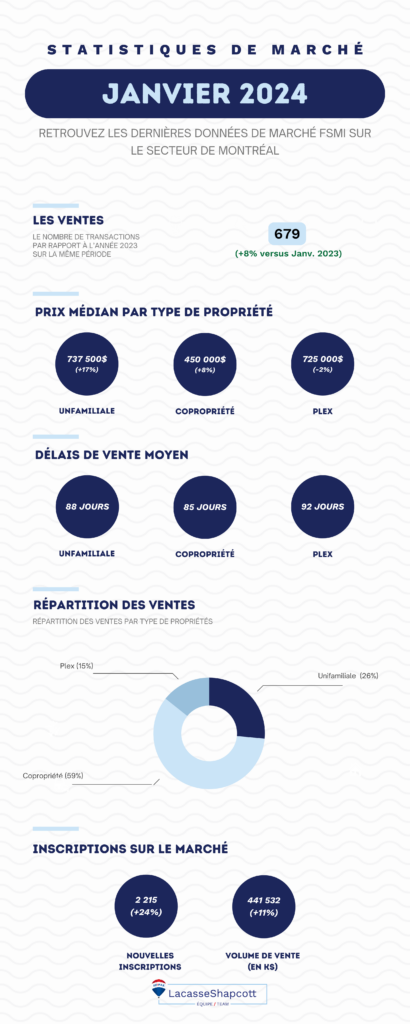

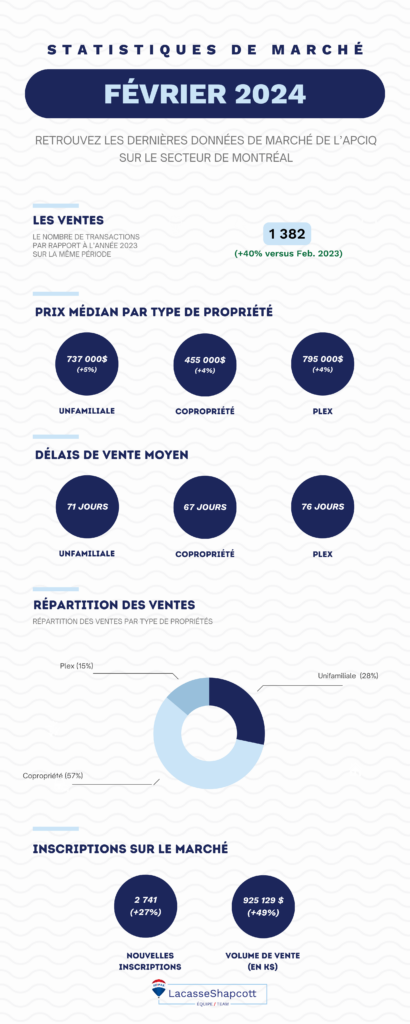

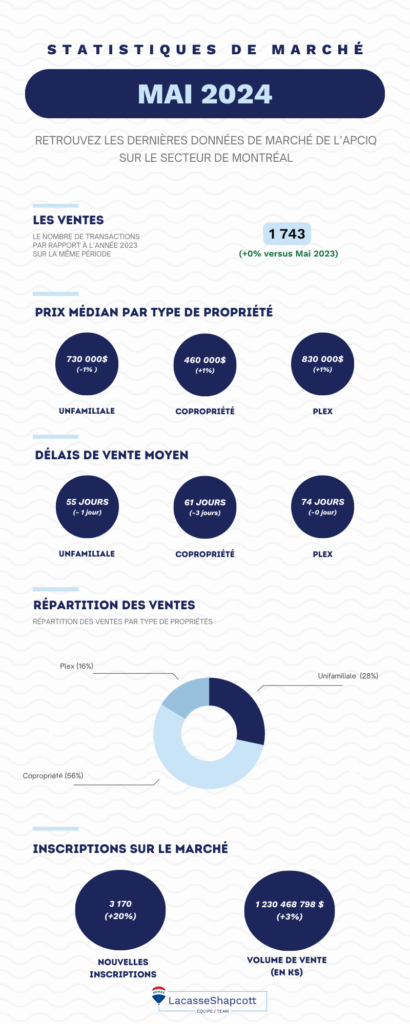

Discover the real estate statistics for the other months of 2024 :

The data provided comes from the official APCIQ website. Download the official report here.

More recent statistics :

Montreal property sales prices – April 2024

April 2024 presented some interesting nuances in terms of property sales prices in Montreal. After the significant increases seen at the start of the year, April saw a return to a degree of stability, revealing a more mature local real estate market.

Price stabilization

Property prices showed signs of stabilization across different market segments, with slight fluctuations reflecting a well-balanced market:

- Single-family homes: The median price for single-family homes was $705,000, up 4% year-on-year, but 4.2% lower than the previous month. This moderate increase is indicative of the sustained demand for this type of property, particularly popular with families looking for space and comfort.

- Condominiums: Condominiums continued to play a dominant role in the market, with a median price of $460,000, up 5% on the previous year, but up only 1.3% on the previous month, a sign of stabilizing prices. This segment continues to attract a wide range of buyers, from first-time buyers to investors, thanks to its diversity of offerings and relatively affordable prices compared to single-family homes.

- Plexes: Plexes, which include properties ranging from two to five units, saw their median price rise to $807,000, marking a 6% increase over 2023, but only 1.5% over March 2024. This increase is slightly higher than for other property types, reflecting the increased value these units can generate in terms of rental income.

“This stabilization should not be seen as alarming in view of market conditions. After several consecutive months of price rises, the fact that prices are holding steady is more indicative of a psychologically acceptable price for buyers than of a future decline or speculative bubble.”

Kyle Shapcott, leader in real estate.

Implications and consequences for market players

This price stabilization can be attributed to several key factors.

Maintained interest rates have kept borrowing conditions acceptable and helped define the psychological threshold for financing in the market, supporting demand despite global economic uncertainties. In addition, the supply of new construction, the marketing of renovated properties and government initiatives are reinforcing the market’s need to meet growing demand, while tempering pressure on prices.

In terms of statistics, we can observe

Implications for players :

- For buyers, price stabilization offers an opportunity to negotiate with greater leverage, especially in segments where competition is less intense.

- For sellers, current conditions are keeping selling prices attractive, especially if they have invested in improvements or are located in high-demand neighborhoods.

In summary, although the market showed signs of stabilizing in April 2024, the outlook remains positive, with conditions conducive to sustained activity. Potential buyers should remain vigilant and informed of local trends to make informed choices, while sellers could benefit from a well-targeted marketing strategy to maximize their gains. Whatever the situation, the support of an expert Montreal real estate broker is a major asset in realizing your real estate projects.

Time to sell Montreal properties

April 2024 saw a remarkable evolution in property sales times, testifying to the agility and vitality of the Montreal real estate market. These changes are particularly significant, as they reflect the confidence of buyers and the speed with which properties change hands.

There has been a noticeable reduction in sales times in several property categories, underlining robust demand and a competitive market:

- Single-family homes: The average selling time for single-family homes decreased by 4 days to 56 days. This represents a significant improvement on previous months, when lead times could be as long as two months. This reduction can be attributed to strong demand from families seeking to take advantage of the advantageous financing conditions and the diversity of options available on the market.

- Condominiums: The average sales time for condominiums fell to 64 days (versus 65 days in March). This segment continues to attract a wide range of buyers, thanks to its affordability and the variety of properties on offer, from studios for singles to larger units for families.

- Plexes: The average lead time for plexes fell slightly to 74 days, compared with 76 in March. Although these properties require a greater financial commitment, they remain attractive to investors and owner-occupiers thanks to their rental income potential.

Several factors have contributed to this reduction in sales lead times. These include the stabilization of interest rates, seasonality and the country’s economic conditions, which are tending towards growth.

“The Montreal real estate market in April 2024 clearly demonstrated that conditions are ideal for fast and efficient transactions .With the summer season approaching, we anticipate that these trends could continue over the next few weeks, offering excellent opportunities for all market players.”

Kyle Shapcott, co-founderLacasse Shapcott.

Breakdown of real estate sales Montreal – April 2024

The breakdown of real estate sales in Montreal continued to reflect clear preferences for certain property types, with condominiums dominating, followed by single-family homes and plexes.

This trend is indicative of local market dynamics and consumer choices in the face of a variety of economic and social factors.

Sales breakdown analysis :

- Condominiums: This type of property accounted for 56% of real estate transactions in April, consolidating its position as market leader. The appeal of condominiums is underpinned by their relative affordability, often central location, and low maintenance requirements, making them particularly attractive to first-time buyers and investors.

- Single-family homes: Single-family homes account for 29% of sales, attracting mainly families looking for extra space and privacy. Demand for this type of property remains strong, particularly in residential areas where the environment and associated services (schools, parks, etc.) add to their value.

- Plexes (2-5 units): Plexes account for 15% of transactions, a stable share that underscores their continued popularity among investors seeking rental income. These properties offer the possibility of combining investment and personal living, an attractive formula in the current economic climate.

Find out more about our monthly statistical analyses in our articles!

- Real estate Montréal : Real estate market statistics May 2025

- Real estate Montréal : Real estate market statistics April 2025

- Real estate Montréal : Real estate market statistics March 2025

Registrations and sales volumes Montreal, April 2024

Montreal’s buoyant real estate market is also reflected in the number of listings and sales volume.

Real Estate Market News Montreal, April 2024

April 2024 marked a significant period of growth for the Montreal real estate market, characterized not only by increases in sales volume, but also by a notable rise in market listings. These two indicators testify to the strength and confidence currently prevailing in the Montreal-area real estate market.

Increase in registrations: The number of new listings saw an impressive rise in April, with an increase of 33% over the same period last year. This increase in listings indicates that more homeowners are ready to sell their properties, often motivated by favorable market conditions, attractive prices, and an economic recovery that is stimulating real estate activity.

Overall, the market recorded 3,106 new listings in April, reflecting optimism among sellers and expectations of strong demand.

Sales volume real estate market Montreal, April 2024

Sales volumes also followed an upward trajectory, with an increase of 16% compared to April 2023. This dynamism in sales illustrates the market’s increased capacity to rapidly absorb newly listed supply, supported by active buyers and ongoing investment in the real estate sector.

Total real estate transactions reached around $1.18 billion in April, a sign of a booming market and renewed confidence in real estate investment.

Read the full analysis and our forecasts for the Montreal real estate market in 2024 in our blog.

Conclusion

Montreal’s real estate market in April 2024 continued to show strong signs of growth, with stable prices, reduced selling times, and increased listings and sales volumes.This dynamic activity is supported by stable interest rates and a favorable spring season, offering ideal conditions for buyers and sellers.

Current trends indicate that the market is set to remain robust, with exciting opportunities for all players in the real estate market. For those considering buying or selling, it’s essential to engage with local experts like the Lacasse Shapcott team to effectively navigate this market and achieve successful transactions.

Other articles to discover on our blog!