Real estate Montréal : Real estate statistics May 2024

Real estate Montréal : Real estate statistics May 2024

Main information:

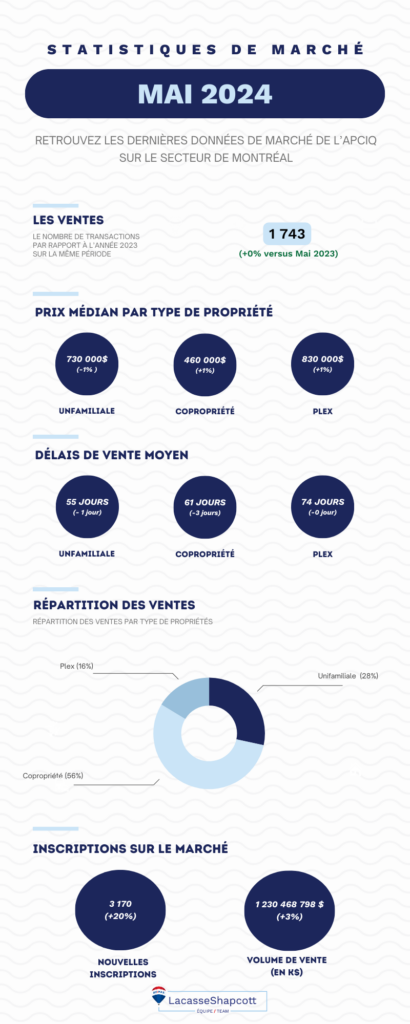

- Overall price stability: Condominium prices rose by 1% ($460,000) and plexes by 1% ($830,000), while single-family homes fell slightly by 1% ($730,000).

- Decrease in sales times: The average selling time has fallen to 55 days for single-family homes and 61 days for condominiums, indicating an acceleration in transactions.

- Sales breakdown: Condominiums represent 56% of sales, single-family homes 28%, and plexes 16%, reflecting diversified buyer preferences.

- Increase in listings: New listings rose by 20% to 3,170, signalling an increased supply on the market.

- Sales volume up: Total sales volume increased by 3% to $1,230,468,798, indicating sustained, dynamic activity in the real estate market.

- Montreal’s real estate market is showing strong signs of resilience and should continue to grow in the coming weeks with the recent drop in interest rates.

Kyle analysis in video :

The Montreal real estate market in May 2024 shows interesting trends and significant variations from previous months and the previous year. Looking at APCIQ data for May and previous months, such as March 2024 and April 2024, we see that the market remains stable with slight fluctuations in different segments, a sign of an overall growing market with every player, buyer or seller, making transactions.

Let’s take a closer look at the real estate statistics for May 2024.

Time needed: 7 minutes

- Montreal real estate market, May 2024

- Montreal property prices – May 2024

- Property sales deadline Montreal – May 2024

- Breakdown of real estate sales Montreal – May 2024

- Registrations and sales volumes Montreal – May 2024

Montreal real estate market, May 2024

The Montreal real estate market in May 2024 shows general stability, with minor variations in various sectors. The trends observed in April continue, with slight adjustments. According to the April 2024 statistics, the market experienced moderate growth. In May 2024, this trend continues, with sales stabilizing, reflecting stable demand despite global economic fluctuations.

Condominium prices rose by 1% to $460,000, while single-family home prices fell slightly by 1% to $730,000. Plex prices also increased by 1%, reaching $830,000. Average selling times also improved: 55 days for single-family homes (down 1 day), 61 days for condominiums (down 3 days), and stable at 74 days for plexes.

Lastly, new listings were up 20%, and total sales volume was up 3%. These trends show sustained demand and a price level that seems to be accepted by all, while properties are staying on the market for less and less time and inventory is increasing, we can expect the market to accelerate in the coming weeks, fuelled by falling interest, offering interesting opportunities for buyers and investors.

Read the statistics every month on our blog :

- Real estate Montréal : Real estate market statistics May 2025

- Real estate Montréal : Real estate market statistics April 2025

- Real estate Montréal : Real estate market statistics March 2025

- Real estate Montréal : Real estate market statistics February 2025

- Real estate Montréal : Real estate statistics January 2025

- Real estate Montréal : Real estate statistics December 2024

Montreal property prices – May 2024

Property sales prices in Montreal in May 2024 showed interesting variations by property type.

Looking at the figures, the median price of condominiums rose by 1% to $460,000. This rise continues to indicate sustained demand for this type of housing, probably due to their affordability and the preference of young buyers and investors. The trend for condominiums to offer more convenient and often more affordable living in urban areas remains a key factor in this growing demand.

| Property type | Median prices | Variation (%) |

|---|---|---|

| Co-ownership | 460 000 $ | +1% |

| Single-family home | 730 000 $ | -1% |

| Plex | 830 000 $ | +1% |

For single-family homes, the median price fell slightly by 1% to $730,000. This marginal decline can be attributed to a number of factors, including a slight easing of demand after a period of high activity, influenced by the seasonality that drives the market. It is possible that some potential buyers were faced with budgetary constraints due to rising interest rates, causing them to delay or reconsider their purchases. The recent drop in rates could create a pivot on this price level and see the price of these types of properties rise.

Plexes also saw a 1% increase in their median price, reaching $830,000. This increase reflects the continuing interest in income-generating properties, such as plexes, which enable owners to benefit from additional rental income. Investors see these properties as effective ways to diversify their portfolios and maximize returns in a relatively stable real estate market.

“Condominiums continue to attract buyers due to their relatively low price and practicality, while single-family homes are undergoing a slight correction after a period of strong demand. Plexes, meanwhile, remain attractive to investors looking for passive income. Overall, the market is showing notable resilience, with adjustments reflecting varied economic conditions and buying preferences.”

Kyle Shapcott, founder Lacasse Shapcott.

Read all about property types in Montreal in our article on the subject.

Deadline for selling properties in Montreal – May 2024

The average time-to-sale for properties in Montreal in May 2024 showed notable improvements for certain property categories. Here is a summary of the data:

| Property type | Salestime (days) | Variation (days) |

|---|---|---|

| Single-family home | 55 | -1 |

| Co-ownership | 61 | -3 |

| Plex | 74 | 0 |

Single-family homes sell in an average of 55 days, a reduction of one day on the previous month. This slight decrease may indicate continued strong demand for single-family homes, despite a slight drop in prices. Buyers continue to seek out this type of property, probably because of the space and benefits it offers, especially for families.

For condominiums, the average selling time fell by three days to 61 days. This more pronounced reduction suggests a significant acceleration in transactions in this segment. Several factors may explain this trend, including the continuing appeal of condominiums due to their affordability and often central location.

For plexes, the time-to-sale remains stable at 74 days. This longer lead time compared to other types of property can be explained by the specific nature of these assets, which are often purchased for investment purposes. Plex buyers generally take more time to assess profitability and rental income prospects before finalizing their purchase. What’s more, plexes often require more negotiation and red tape, prolonging the selling process.

In short, the reduction in sales times for single-family homes and condominiums is a positive indicator of the fluidity of the Montreal real estate market. Sellers can look forward to completing their transactions more quickly, which is a sign of a healthy, dynamic market. For investors, the stability of plex sales lead times confirms continued interest in this type of property, despite the longer sales process. Overall, these trends point to an improvement in the liquidity of the Montreal real estate market.

Breakdown of real estate sales in Montreal – May 2024

The breakdown of real estate sales in Montreal revealed some interesting trends in terms of buyers’ preferences for different types of property. Data analysis :

- Condominiums: 56% of sales, underlining their attractiveness due to their more affordable price and central location in sought-after urban areas. Young buyers, professionals and rental investors often prefer condominiums for their value for money and ease of management.

- Single-family homes: 28% of sales, reflecting solid but more segmented demand. Families looking for more space, gardens and a certain amount of peace and quiet often opt for single-family homes, despite higher prices and a location sometimes on the outskirts of urban centers.

- Plex: 16% of sales, they remain an attractive choice for investors. These properties offer the possibility of generating rental income, which can offset the higher purchase cost and management requirements. Investors see plexes as an opportunity to diversify and stabilize their real estate portfolios.

The breakdown of real estate sales clearly shows a marked preference for condominiums, followed by single-family homes and plexes. This distribution, which has varied little since the beginning of the year, highlights current market trends, where buyers are looking for affordable, convenient and well-located housing solutions. Investors continue to value plexes for their income potential, despite relatively lower sales volumes.

This diversity in property choices reflects the adaptability of buyers and investors to economic conditions and the dynamics of the Montreal real estate market.

Registrations and sales volumes in Montreal – May 2024

New listings and sales volumes in Montreal showed significant and interesting trends. Here is an overview of the data:

| Indicator | Value | Variation (%) |

|---|---|---|

| New listings | 3 170 | +20% |

| Sales volume (in $) | 1 230 468 798 $ | +3% |

New registrations rose by 20% to 3,170. This significant increase indicates that more homeowners are ready to sell, perhaps anticipating stable or slightly higher prices. This trend could accelerate with the recent fall in interest rates, making the financing of new acquisitions more attractive to potential buyers.

Total sales volume also rose by 3%, to $1,230,468,798. This modest but significant increase reflects sustained activity in the Montreal real estate market. The increase in sales volume is consistent with trends observed in the condominium, single-family home and plex segments, where demand remains strong despite fluctuations in prices and selling times.

“The recent drop in interest rates could further stimulate the Montreal real estate market in the coming months, by making mortgages more affordable and increasing buyers’ purchasing capacity. The increase in inventory and transaction volumes are, in my opinion, a very good indicator of a resilient market ready to accelerate at the start of summer, a strategic period on the market.”

Kyle Shapcott

In conclusion, the May 2024 indicators show a notable increase in new listings and a rising sales volume, suggesting sustained and potentially growing activity in the Montreal real estate market.

Recent declines in interest rates could reinforce these trends and offer attractive opportunities for buyers and investors.

Conclusion

The Montreal real estate market showed overall stability with some notable variations in May, reflecting the seasonality of the period, the changing dynamics of demand and supply, and a marked resilience in the real estate market.

Prices are generally stable, and sales lead times have fallen, suggesting a certain dynamism in the market despite inflation, which at last seems to be slowing. Finally, the increase in new listings and sales volume shows that the market remains very attractive for the various players. The recent fall in interest rates could bring a wave of dynamism to the market and improve these various indicators in the weeks ahead.

In sum, analysis of the May 2024 data shows that the Montreal real estate market remains resilient and adaptable to economic conditions and buyer preferences.The short-term outlook remains positive, with continued growth potential supported by favorable interest rates and increasing demand.

If you have a project in mind, contact our team of Montreal real estate brokers.

Our blog is packed with tips, news and value to help you understand everything about the real estate market!

- Montréal real estate market: Trends to watch for summer 2025

- Montréal real estate market: How high will prices go?

- Town of Mount Royal events this summer

- Real estate Montréal : Real estate market statistics May 2025

- Do Open Houses Still Work in the Age of Virtual Tours?

- Montréal real estate market: everything you need to know about Airbnb short-term rentals