From dream to reality: The checklist for buying your property

From dream to reality: The checklist for buying your property

Key facts:

Financial assessment: Before you start house hunting, assess your financial health by checking your credit rating, debt-to-income ratio and savings to ensure a solid financial foundation.

Mortgage pre-approval: Getting a mortgage pre-approval helps you know how much you can spend and shows sellers that you’re a serious buyer, which can be an advantage in a competitive market.

Choosing the right location: Choosing the right location involves considering factors such as safety, access to schools and amenities, and proximity to work, which can improve your quality of life and increase the value of your property over time.

Real estate broker: A good real estate broker, with in-depth knowledge of the local market and a track record of successful transactions, can guide you through every step of the buying process, from initial research to negotiations and closing.

Buying a property is an important step, especially in a dynamic city like Montreal. Understanding the right time to enter the market can be difficult, as can the procedures and various stages of a real estate project.

This is where a well-structured property purchase checklist becomes invaluable. Whether you’re navigating Montreal’s bustling real estate market for the first time or looking to upgrade your home, our checklist helps you know when to buy and simplifies the whole process.

Time needed: 10 minutes

Table of contents :

- Assess your financial health

- Understanding the difference between your needs vs. your desires

- Get pre-approved for a mortgage

- Define your criteria and locations

- Find a real estate broker

- Property search and inspection

- Formulate an offer and negotiate

- Closing the deal and final thoughts

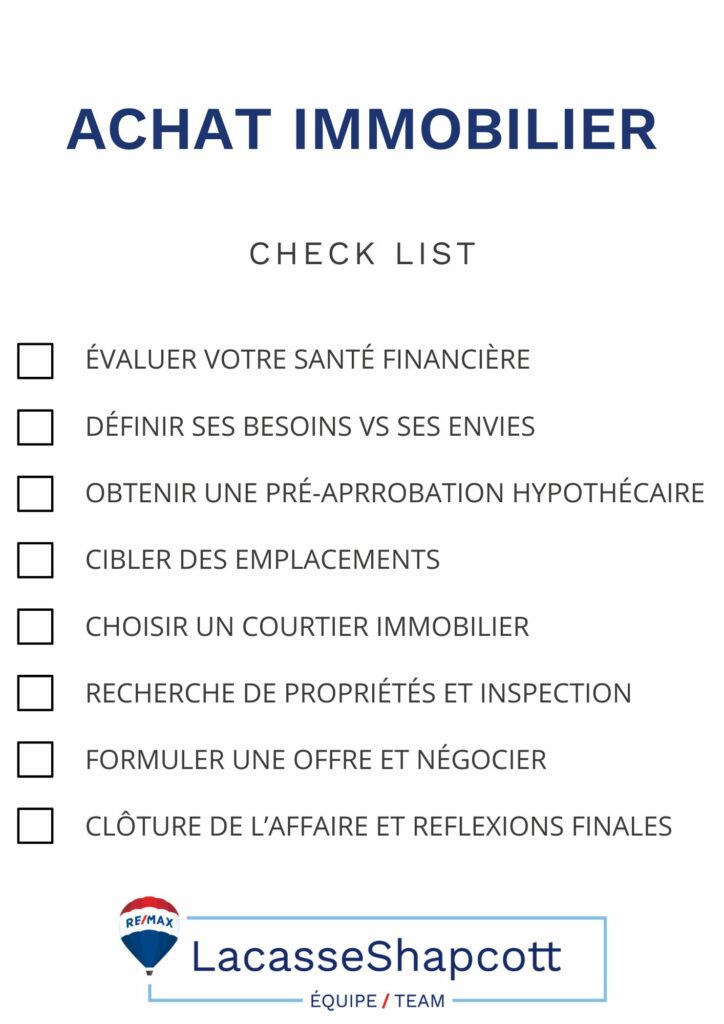

Find the complete checklist in pictures :

Property buyingchecklist step 1: Assess your financial health

A thorough assessment of your financial health should always be the first step in your real estate checklist.

It’s crucial to understand your financial situation before diving into the market. Start by checking your credit rating, which will affect your mortgage rates and loan approval.

“Understanding your financial situation is the first step to a successful real estate purchase. Good financial preparation will enable you to navigate the market with confidence.”

Kyle Shapcott

Next, assess your debt-to-income ratio; lenders generally prefer a ratio below 36%. Don’t forget to factor in your savings, making sure you have enough for a down payment and additional costs such as closing costs and moving expenses.

Websites offering advice on real estate purchasing strategy often stress the importance of this financial foundation, as it sets the stage for a smooth buying process.

There are 3 key steps to assessing your financial health:

- Check your credit rating: This will affect your mortgage rates and loan approval.

- Evaluate your debt-to-income ratio: Lenders generally prefer a ratio of less than 36%.

- Consider your savings: Make sure you have enough for a down payment and additional costs such as closing costs and moving expenses.

Property checklist step 2: Understanding the difference between your needs and desires

Identifying what you need versus what you want in a home is a crucial step in the real estate buying process.

Start by listing the essential features that suit your lifestyle and your family’s needs, such as the number of bedrooms, accessibility features or proximity to work.

Once you’ve defined your needs, consider your desires. This could include a large garden, a renovated kitchen or additional amenities such as a home gym.

“Knowing how to distinguish between what you must have and what you’d like to have in a home is essential to a successful real estate purchase.”

Valérie Lacasse

It’s essential to prioritize your needs, as they influence your long-term satisfaction and comfort.

This is especially true for those moving to Montreal from afar, as they will face even higher expenses. Long-distance moves can be complex and expensive, so knowing exactly what you need will help you coordinate with movers and reduce the likelihood of making the wrong choice of property, saving time and resources.

Here is a table with examples of different needs vs. wants:

| Needs | Desires |

|---|---|

| Enough bedrooms quantity | Large garden |

| Parking | Furnished kitchen |

| Accessiblity features | GYM room |

| Furnished property | Domotic |

| Near metro | Swimming-pool |

| Special district | South-facing |

| Type of property (condo, house..) | High ceilings |

Property checklist step 3: Get pre-approved for a mortgage

Getting pre-approved for a mortgage clarifies how much you can afford to spend. What’s more, it shows sellers that you’re a serious buyer.

In Montreal, where the real estate market can be competitive, having a pre-approval letter can give you an edge in negotiations. Start by consulting several lenders to compare interest rates and conditions.

These days, interest rates can vary considerably, and choosing the right mortgage could save you thousands of dollars over the life of the loan.

What’s more, understanding the different types of mortgages available, such as fixed-rate, variable-rate or government-backed loans, will enable you to make an informed decision that aligns with your financial goals. This prudent approach ensures you enter the market with confidence and secure your financial stability in your new Montreal home.

We’ve devised a winning strategy for today’s real estate market.

See our guide to find out more.

Property checklist step 4: Choosing the right location

Choosing the right location isn’t just about finding a beautiful home.

It’s about lifestyle and the amenities that go with it. Consider factors such as safety, schools, accessibility to work and community amenities.

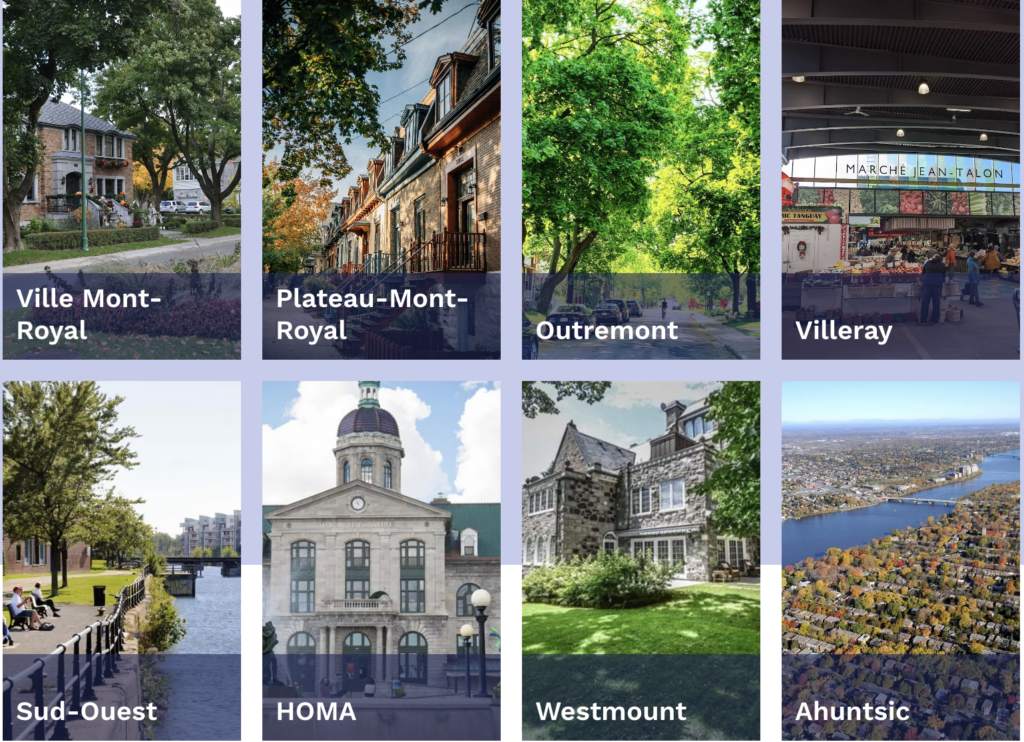

Find out more about each of Montreal’s neighborhoods in our neighborhood fact sheets!

Remember, a good location improves your quality of life and can also see its value increase over time, by making a wise investment.

Keeping abreast of major real estate trends will help you identify areas likely to increase in value. Our teams regularly write articles on different Montreal neighborhoods as well.

- Town of Mount Royal events this summer

- Montreal’s best neighborhoods for first-time buyers

- Villeray immobilier : All about the neighborhood

Checklist property purchase step 5: Find a real estate broker

Selecting the right real estate broker is crucial, especially in a competitive market like Montreal.

A skilled broker can be your best ally, giving you access to listings that might not be publicly available and offering information on neighborhood trends and property values.

Choose someone who is well known in Montreal, with a proven track record of successful transactions and in-depth knowledge of the local market.

“A good real estate broker can turn a stressful experience into a pleasant and successful adventure. That’s what we’re all about in our team, offering tailor-made, transparent and professional support to our customers.”

Valérie Lacasse

An experienced broker will guide you through every step of the buying process, from house hunting to negotiations and closing.

They can also help interpret complex documents and ensure that you meet all legal requirements. Finding a broker who understands your needs and communicates clearly will make your real estate buying journey smoother and more enjoyable.

To make the right choice, don’t panic, we’ve written comprehensive articles on the subject!

- Buying a vacation property in the Montreal suburbs

- The importance of location in your real estate project

- Montreal real estate: the different types of properties

Property checklist step 6: Property search and inspection

When you start house-hunting, pay special attention to your visits and be thorough during inspections.

Look beyond surface aesthetics to assess elements such as the condition of the roof, plumbing and electrical systems. A thorough home inspection may reveal critical problems that could lead to costly repairs in the long term, but may also justify lower bids.

Addressing these issues early on with the seller can save you considerable trouble and expense.

Here is a list of items to check during visits and inspections:

- Roof condition: Provides protection from the elements.

- Plumbing system: Checks for leaks and proper operation.

- Electrical system: Ensures safety and compliance with standards.

- Foundations and structure: Checks the structural integrity of the house.

- Insulation and energy efficiency: Checks the quality of your home’s insulation and energy efficiency.

Property checklist step 7: Making an offer and negotiating

Once you’ve found the home of your dreams, the next step on your real estate checklist is to make an offer.

Formulating a convincing offer requires an understanding of market value, the seller’s expectations and current competing offers. Start by discussing with your real estate broker the best strategies for making your offer stand out while staying within a reasonable price range.

Here are some tips on how to make an offer and negotiate effectively:

- Understanding market value: Look for similar properties in the area to get an idea of the right price.

- Know the seller’s expectations: Try to understand what’s important to the seller (e.g. an early closing date).

- Formulate an attractive offer: Include favorable terms such as a flexible closing date or minimum contingencies.

- Be willing to compromise: Negotiation is a two-way street; be prepared to make concessions to reach an agreement.

Effective negotiation is essential to getting your home at the best possible price. Consider including flexible conditions, such as a favorable closing date or minimum contingencies, which can be attractive to sellers.

Remember, negotiation is a two-way street; be prepared to compromise to achieve a win-win outcome.Following these strategic steps will increase your chances of realizing your dream of home ownership.

Property checklist step 8: Closing the deal and final thoughts

The final step in your real estate buying journey is to close the deal.

This stage involves a lot of paperwork and legal formalities. Make sure you have all the necessary documents ready, such as your loan agreement, home inspection reports and insurance policies.

Understanding what to expect on closing day will help ensure a smooth transition to ownership.

Here’s a checklist to help you close the deal:

- Prepare all necessary documents: loan agreement, inspection reports, insurance policies.

- Include closing costs: notary fees, property transfer fees, tax adjustments.

- Plan the closing date: Make sure all participants (seller, real estate agent, notary) are available.

- Review the sales contract: Make sure all the conditions of the offer have been met.

- Check financing: Confirm that your mortgage is approved and ready for disbursement.

By following these steps, you can close your offer smoothly and efficiently, minimizing the risk of delays or complications.

Conclusion

To succeed in the home-buying process, it’s not enough to want to find the ideal home; you need to adopt a strategic approach, especially in a market as dynamic as Montreal’s.

So our home-buying checklist is more than just a tool. Make it your personal roadmap through the complex terrain of real estate. It will leave you prepared, informed and ready to make decisions that fit your financial goals and lifestyle. By following this checklist, you’ll find a home in Montreal and a place you can truly call home.

Contact us to make your real estate dreams come true.

Valérie Lacasse

Valérie has been a real estate broker for over 10 years. Passionate about the industry and Montreal, she is one of Montreal’s most influential brokers, guaranteeing expertise and comprehensive support for her customers.

More articles and news on our blog!