Hidden costs of homeownership: Budgeting beyond the purchase price

Hidden costs of homeownership: Budgeting beyond the purchase price

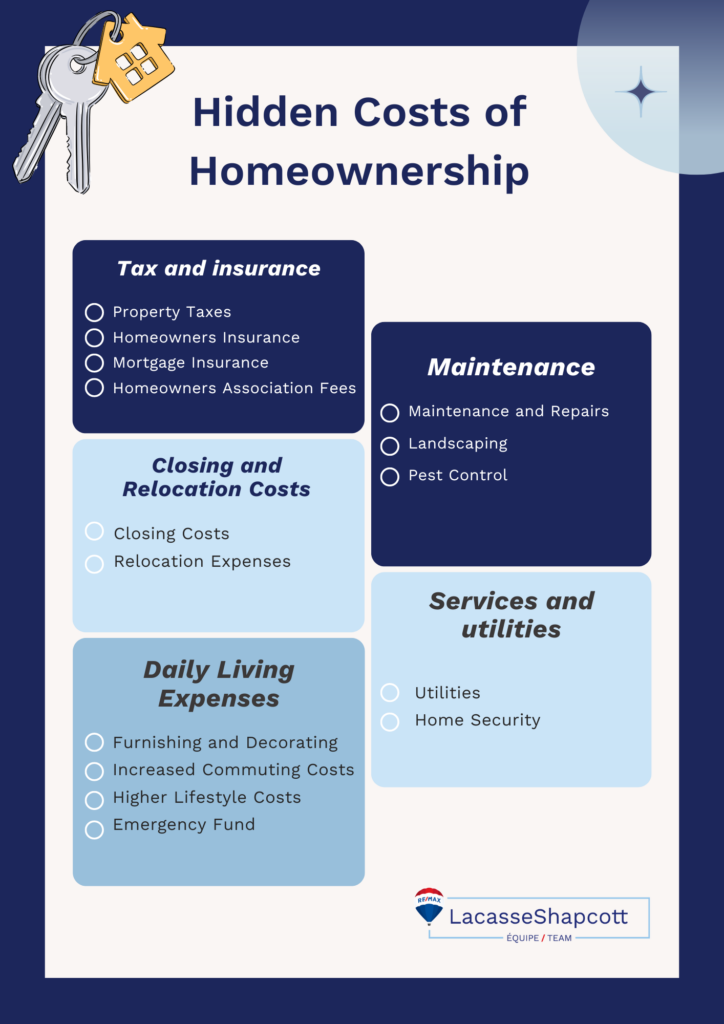

- Key facts :

- Property taxes: Vary widely based on location and on the home’s assessed value.

- Homeowners insurance: Costs depend on location, home age, and coverage amount. It is essential for protection against damage or loss.

- Mortgage insurance: Necessary for down payments of less than 20%; ranges from 0.3% to 1.5% of the loan amount per year.

- Closing costs: These include fees for appraisals, inspections, and legal services, which typically range from 2% to 5% of the home’s purchase price.

- Furnishing and decorating: Costs for furniture, appliances, and decor can add up quickly; budget for these expenses.

- Increased commuting costs: Longer commutes may result in higher fuel, vehicle maintenance, or public transportation costs.

- Higher lifestyle costs: New neighborhoods may have higher prices for goods and services; adjust your budget accordingly.

When buying a home, many people focus on the purchase price and the down payment. However, there are numerous hidden costs of homeownership that can catch new homeowners off guard. These additional expenses can significantly impact your budget, making it essential to plan beyond the initial purchase price. Get some valuable tips on how to budget for hidden costs effectively.

Discover all the hidden costs of homeownership.

Reading time 7 minutes

- Property taxes

- Homeowners insurance

- Maintenance and repairs

- Utilities

- Relocation expenses

- Homeowners association fees

- Mortgage insurance

- Closing costs

- Furnishing and decorating

- Landscaping

- Pest control

- Home security

- Increased commuting costs

- Higher lifestyle costs

- Emergency fund

- Final thoughts on the hidden costs of homeownership

Property taxes

One of the most significant hidden costs of homeownership is property taxes. They are based on the assessed value of your home and can vary widely depending on the location. Some areas have higher property taxes due to better schools, infrastructure, and public services. It’s necessary to research the property tax rates in your desired area and include them in your budget.

Homeownership insurance

Homeowners insurance is another essential expense that is often overlooked. This insurance protects your home and belongings from damage or loss due to events like fire, theft, or natural disasters. The cost of homeowners insurance can vary depending on the following:

- The location

- Age of the home

- Coverage amount

Be sure to shop around and compare quotes from different insurance providers to find the best deal.

Homeowners insurance is not just an added expense; it’s a crucial investment in safeguarding your property and peace of mind. As a homeowner, understanding the specifics of your coverage and the factors influencing your insurance costs can make a significant difference

Kyle Shapcott

Maintenance and repairs

Owning a home means taking responsibility for all maintenance and repairs. Unlike renting, where the landlord handles repairs, homeowners must budget for these costs themselves. Routine maintenance tasks such as lawn care, cleaning gutters, and servicing HVAC systems can add up over time.

Additionally, unexpected repairs like a leaky roof or a broken water heater can be expensive. Setting aside a portion of your monthly budget for maintenance and repairs is advisable to avoid financial strain.

Utilities

One of the hidden costs of homeownership can be utility costs. This can turn out to be a significant expense for homeowners. Utilities include:

- Electricity

- Water

- Gas

- Sewer services

The size of your home, the number of occupants, and your location can all impact your utility bills. Energy-efficient appliances and practices can help reduce these costs, but you must factor them into your overall budget.

Relocation expenses

Homeownership itself comes with plenty of expenses, but add to that making a long distance relocation to reach your new home, and you might immediately reach for your calculator. To illustrate, consider the idea of moving from Ontario to Quebec. It’s extremely important to understand the financial implications of such a move. To settle down in Quebec, you might have to account for additional expenses, such as hiring a moving company to organize the relocation for you.

What’s more, property taxes, homeowners insurance rates, and utility costs can differ significantly between the two provinces. Make it a priority to research these differences thoroughly to create an accurate budget.

To make sure you choose a neighbourhood that suits your needs, consult our neighbourhood fact sheets!

Homeowners association fees

If you purchase a home in a planned community or condominium, you may be required to pay homeowners association (HOA) fees. These fees cover the maintenance of common areas, amenities, and sometimes utilities. HOA fees can vary widely depending on the community and the services provided. Make sure to inquire about any HOA fees and include them in your budget.

Mortgage insurance

If you make a down payment of less than 20% on your home, you will likely be required to pay private mortgage insurance (PMI). PMI protects the lender in case you default on your loan. The cost of PMI can range from 0.3% to 1.5% of the original loan amount per year. Make sure you factor in this additional cost if your down payment is less than 20%.

Closing costs

Closing costs are another example of hidden costs of homeownership that can catch homebuyers by surprise. These costs include fees for appraisals, inspections, title searches, and legal services. Closing costs can range from 2% to 5% of the home’s purchase price. Have detailed discussions with your real estate agent on this topic and budget for the costs to avoid any last-minute financial stress.

Increased commuting costs

If your new home is located further from your workplace or essential services, you may experience increased commuting costs. This includes additional fuel expenses, vehicle maintenance, and potentially higher public transportation costs.

Higher lifestyle costs

Moving to a new home can also lead to higher lifestyle costs. This can include everything from joining new local clubs or organizations to higher grocery prices in your new neighborhood.

Emergency fund

Every homeowner must have an emergency fund set aside for unexpected expenses. Homeownership can come with unforeseen costs, such as sudden repairs or medical emergencies. Having an emergency fund can provide financial security and peace of mind.

Additional hidden costs of homeownership

Once you move in, you might want to make some additional investments and changes. Some of them may include the following:

- Furnishing and Decorating—Once you move into your new home, you’ll likely want to furnish and decorate it to your taste. The cost of furniture, appliances, and decor can add up quickly.

- Landscaping—If your new home has a yard, you’ll need to consider the landscaping as one of the hidden costs of homeownership. Whether you plan to do the work yourself or hire a professional, maintaining a lawn, garden, and outdoor spaces can be expensive. Regular lawn care, planting flowers, and maintaining trees and shrubs should all be factored into your budget.

- Pest Control—Regular pest inspections and treatments can help prevent infestations and protect your home from damage. Depending on your location and the prevalence of pests, this could be a necessary recurring expense.

- Home Security—Investing in a home security system can provide peace of mind and protect your property. The cost of security systems can vary widely, from basic alarm systems to advanced surveillance setups. Monthly monitoring fees should also be considered when planning for home security.

Be aware of everything to know when buying a home :

- Buying a vacation property in the Montreal suburbs

- The importance of location in your real estate project

Final thoughts on the hidden costs of homeownership

Homeownership is a significant financial commitment that goes beyond the purchase price of a home. Understanding and budgeting for the hidden costs of homeownership can help you better prepare yourself for the financial responsibilities of owning a home. Remember to research property taxes, maintenance and repair costs, mortgage insurance, closing costs, furnishing and decorating expenses, and maintaining an emergency fund. By planning ahead and budgeting for these expenses, you can enjoy the benefits of homeownership without unexpected financial stress.

Valérie Lacasse

Valérie has been a real estate broker for over 10 years. Passionate about the industry and Montreal, she is one of Montreal’s most influential brokers, guaranteeing expertise and comprehensive support for her clients.

Our blog posts are full of tips and information about Montreal real estate!

- Real estate Montréal : Real estate market statistics April 2025

- Decorating Tips for Making a New House Feel Like Home

- Rent prices in Montreal: how does the city stack up against major metropolises?

- Real estate Montréal : Real estate market statistics March 2025

- The Pros and Cons of Buying a New Construction Home

- Montreal Real Estate Market – The best times to buy